Stocks Rally to End the Month Positive

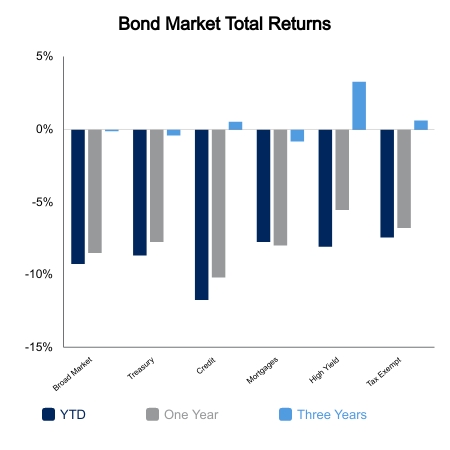

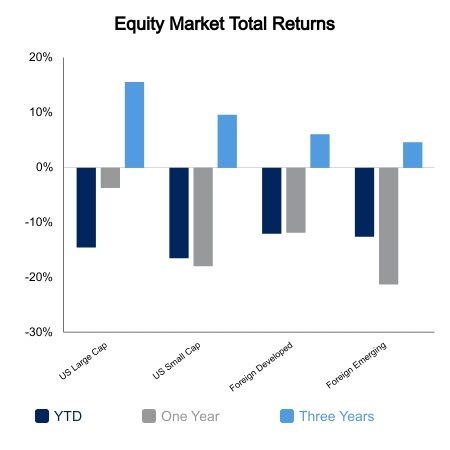

The S&P 500 finished the month up just 0.2%, but at one point the deficit was greater than 5%. The NASDAQ continues to lag and posted a loss of 1.9% in May. Emerging market and foreign developed stocks fractionally outperformed the S&P 500 as the surging U.S. dollar cooled off in recent weeks. Bond prices stabilized which led to positive returns in fixed income.

Central Banks in Focus

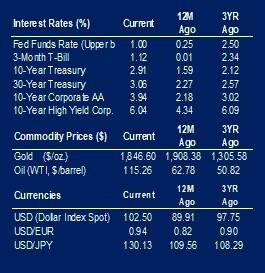

Equities rallied on the potential indication that the Federal Open Market Committee (FOMC) may be poised to pause rate hikes in September. This, combined with stability in yields and oversold conditions, helped fuel a rally from recent lows. However, those initial hopes of a Fed pause took on some cold water this week. Today, the Vice Chair of the FOMC noted that a September pause is unlikely. This came on the heels of similar comments from another official earlier in the week.

These comments could stem from persistently high commodity prices. Many analysts focus on the equity market and whether the recent drawdown has created sufficient tightening in financial conditions. Often ignored are commodity prices, especially the closely watched oil and gas market. Oil prices moved higher this week as Europe moves forward with the process of eliminating its dependence on Russian oil. OPEC marginally increased their production at their meeting today but the impact on prices was muted. Diesel prices and refining margins are extraordinarily high, meaning consumers feel the pain more than what has historically been implied by spot oil prices. It becomes more difficult for the Fed to pause to help reduce financial market pain if the result becomes rising commodity prices from already high levels.

Other central banks are becoming more hawkish, not less in recent days. The Bank of Canada raised rates 50 basis points yesterday and noted they are prepared to move “past neutral”. This is the key phrase Fed watchers will be looking for in future statements. Is the Fed looking to go past neutral or well past neutral? Several key central bank announcements next week will likely headline the news flow.

Economic Data Surprised to the Upside

- ISM Manufacturing came in at 56.1, well ahead of expectations and a sequential improvement

- ISM Prices Paid was higher than expected, but down versus the prior month

- Consumer Sentiment improved, but remains near historic lows

- Personal spending came in better than expected

|

|

Source: BTC Capital Management, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.