Inflation Changes Everything

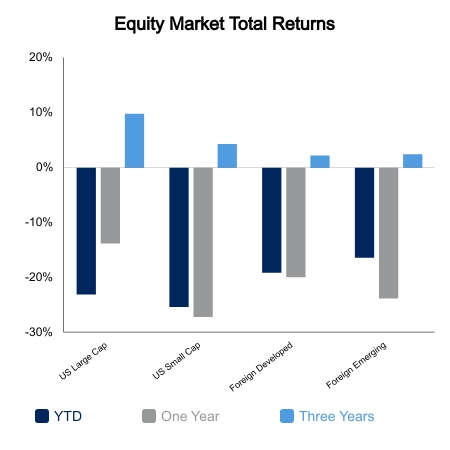

A week ago, the anticipation of a lower-than-expected Consumer Price Index (CPI) print was the foundation of optimism. The S&P 500 was three weeks removed from its lows and about 6% higher. The chatter of the Fed pausing rate hikes in September was a key contributor to this optimism. The consensus was looking for the CPI to increase 0.7% versus the prior month. The number came in at 1.0%, which took the yearly increase to a new cycle high of 8.6%. The next several days would see the S&P 500 set a new low for the year along with several other rare events.

- The Federal Open Market Committee (FOMC) hiked rates for the first time ever while the S&P 500 was down 20% or more.

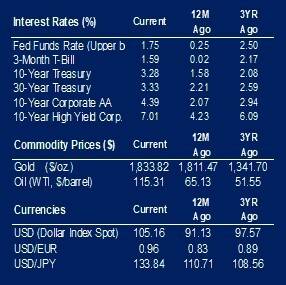

- 2-year Treasury yields spiked 54 basis points in two days, the second-largest move since 1985.

- The 3-day cumulative advancing issues on the S&P was the second worst in series data to 1997.

- Mortgage rates are now up 90% from a year ago. The previous largest gain was in 1980 at +54%.

Central Bank Spotlight

At the last FOMC meeting, Chair Powell made remarks that a 75-basis point hike was not under consideration. Six weeks later they would increase the Federal Funds Rate by 75 basis points, the largest increase since 1994. Bond yields would drop substantially post meeting as their 2022 dot plot of a mid-3% Federal Funds Rate was below the market implied rate of over 4%. The Fed projections now show an increasing unemployment rate and a terminal Federal Funds Rate below peak rates. The message is the Fed is planning to hike beyond neutral to stop inflation.

This week, the European Central Bank (ECB) would convene an emergency meeting as peripheral European sovereign yields surged relative to Germany. Extraordinary easing measures amid low inflation saw investors demand little risk premium to navigate to riskier countries. The prospect of less quantitative easing and higher interest rates has investors repricing risk in quick order. This remains a fundamental problem for the existence of the Eurozone, and it is likely to face its stiffest test in a high inflation regime. The ECB pledged to create a “tool” that will tackle what they are calling fragmentation. Normally, a comment like this, with risk assets oversold, would create a multi-day rally in everything. But lack of details amid a problem with no easy solution resulted in a tepid one-day bounce. It was, however, the first hint at wavering in the central bank’s commitment to tame inflation.

But when the Fed hiked 75 basis points followed by the surprise 50 basis point hike out of the Swiss National Bank, it became clear that consensus among central banks is to dampen demand in the fight against inflation.

|

|

Source: BTC Capital Management, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.