In an unsurprising move, the Federal Reserve Open Market Committee voted to increase the federal funds rate by 0.25% to a range of 0.25-0.50%. The widely signaled moved is the start of an increase cycle. Fed Chair Jerome Powell’s post meeting comments conveyed an additional six increases throughout the year with the potential for four additional increases next year. Fed Chair Powell commented on higher than desired inflation and the potential for higher prices to persist. Their expectation is for inflation to eventually come down to the target of 2% after Fed action.

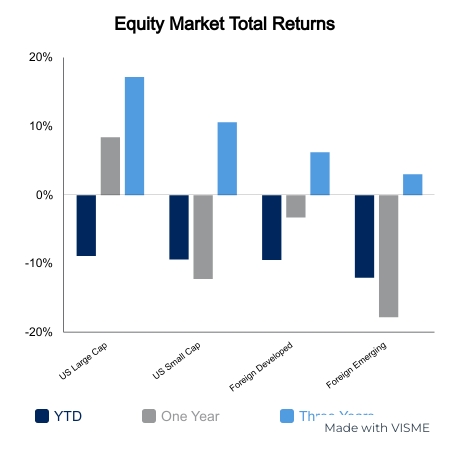

The announcement contributed to positive moves in equity markets. The S&P 500 gained 2.24% the day of the announcement and this strong performance led to positive performance for the week of 1.91%.

The Fed Chair commented on the potential for rapidly rising wages to contribute to increases in broad price levels. Earnings grew by 5.1% in February. After accounting for inflation, real hourly earnings declined by 2.6%. The tight job market with an unemployment rate of 3.8% may contribute to pressures on employers to increase wages in a stronger manner. The concern here is the likelihood of companies passing on the increases to consumers, contributing to the cycle of higher overall prices.

Broadly, prices increased by 7.9% from a year ago as measured by the Consumer Price Index (CPI). The most significant increases came from energy, up 25.6%, and food, up 7.9%. Excluding energy, prices were up 6.4%. Over the month, CPI was up 0.8%. Monthly increases were also led by energy, up 3.5%, and food, up 1%. Excluding energy and food, prices were up 0.50%. Inflation will continue to drive Fed policy throughout the year.

Retail sales were a little lighter than expected in February. Growth of 0.30% was lower than the expected 0.40% and doesn’t compare to the incredibly strong 4.9% from January. The largest increases in sales were from food services and drinking establishments, up 2.5%, and gas stations, up 5.3%. Year-over-year, retail sales are up 17.6%.

Consumer Sentiment, measured by the University of Michigan, dropped again in February. The preliminary reading of 59.7 is the lowest sentiment has been in over a decade. Increasing prices and the Russia-Ukraine war are contributing factors to decreasing sentiment.

We saw a little reprieve in oil price increases this week, as WTI Crude dipped 8%.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.