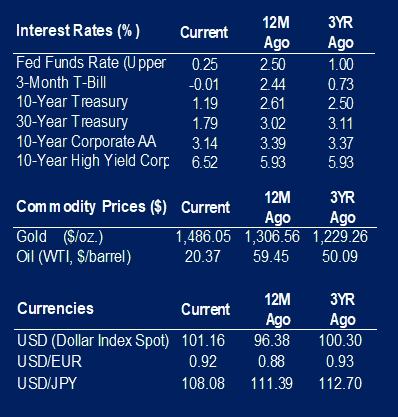

Markets continue to sell-off as the western world shuts down business to minimize the spread of COVID-19 (coronavirus). The S&P 500 was down 12.5% on the week and held up better than other global indices. Domestic small caps were down 21.5% on the week and 41.7% from their highs a couple weeks ago. Emerging market equities are coming under stress as the U.S. dollar is staging a sharp rally. Diversifying assets are providing no help as hedge fund liquidations and other strategies are forced to sell bonds along with all assets. The Bloomberg Barclays Aggregate Bond Index was down 4.0% on the week and gold was off sharply.

Economic data from February has little meaning and the market is turning to more high frequency data. One example is data provided by OpenTable, an online reservation company. On the last day of February online restaurant bookings throughout the country were up 2% versus the prior year. On March 17, the number had fallen all the way to -84%. Traffic congestion is another indicator and it also shows staggering drops across the globe.

As markets drop daily the central banks are rolling out the 2008 playbook to shore up confidence. We highlighted some of these in yesterday’s Insight Extra. The latest one was released last night and included a backstop of the $800 billion in prime money market funds. The European Central Bank in an emergency meeting continued with the alphabet soup of programs by announcing the Pandemic Emergency Purchase Program (PEPP). The PEPP will purchase up to €750 billion of assets. This expands on an existing asset purchase program but does go further by including more eligible securities. Despite aggressive central bank action, the market is waiting for policy from Congress and the Treasury Department on a path forward that will stem the contraction and fear feeding into the credit markets.

Corporate bond spreads have widened materially in the last week. The key company in focus remains Boeing, whose stock has seen an unprecedented fall of roughly 75% in about a month. Once a staple of stability, the market is pricing default probabilities that are two times as high as they were during the 2008-2009 recession. This of course has significant knock-on effects to its suppliers such as General Electric. This feedback loop continues to drive markets and will likely remain in place until appropriate policy action is enacted. Eventually this will happen, but politicians often underappreciate the speed in which action needs to be taken. Thus, risk assets overshoot to the downside.

|

|

Contributed by | Justin Carley, CFA, Managing Director

Justin is a Managing Director, providing portfolio management and credit analysis for fixed income strategies. He also manages the firm’s multi-manager portfolio strategies and contributes to the asset allocation framework. Justin has more than 10 years of experience focusing on management, analysis and trading of fixed income portfolios. Previously, Justin was a fixed income portfolio manager at American Trust & Savings Bank. Justin has a bachelor’s degree from Truman State University, holds the Chartered Financial Analyst designation and holds a Fellowship in the Life Insurance Management Institute.

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involved risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.