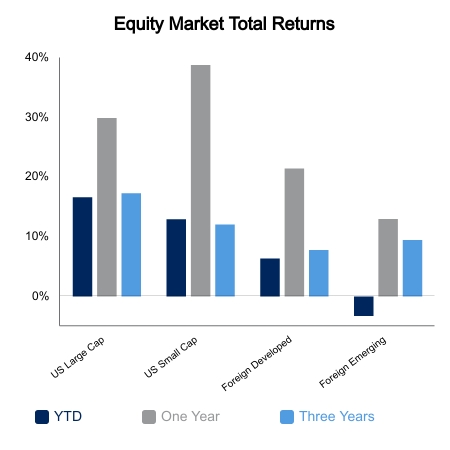

Equity markets faced selling pressure on the week amid mounting risk factors. The S&P 500 was down 3.1% on the week. Small caps fared better with a drop of 2.6%, whereas the NASDAQ Composite was down 4.1% as rising rates scared the duration trade. The Bloomberg Barclays Aggregate Bond Index was down 0.9% as rising rates pressured returns. It is becoming more frequent that bond and equity correlation are lining up, thereby reducing diversification benefits.

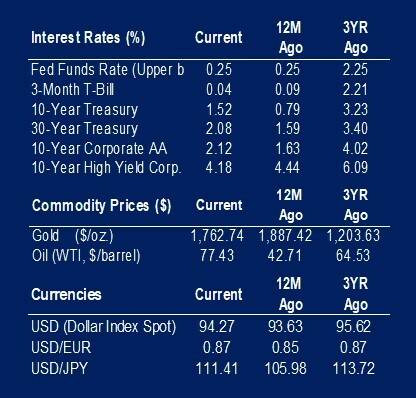

Surging commodities have become a significant risk to the global recovery. They moved to the center stage this week as U.K. natural gas prices have surged 300% in six weeks amid extremely low supply levels. European gas storage levels are at their lowest in 10 years and renewable generation has come in well below expectations. U.S. natural gas prices are also surging, having more than doubled from the start of the year and reaching the highest price since 2008. Oil hit a high as OPEC stuck to their modest increase and U.S. oil production remains more than 10% below its 2020 high. The idea that higher prices would be met with an immediate increase in domestic production is an old narrative that markets are starting to wake up to.

India’s coal inventory is reported as low as 3-4 days and makes up 70% of the country’s electricity output. The benchmark thermal coal price in Australia is up more than 100% in the last six months. The coal equity ETF in the U.S. was delisted in December of last year amid lack of interest as ESG gains popularity. We know what happens next, the Bloomberg US Coal basket is up 282% in 10 months and has returned more than 10 times the S&P 500.

The United States continues to push the limits on resolving the debt as well as struggle to come to an agreement on infrastructure proposals. Federal Open Market Committee Chair Jerome Powell made some comments regarding inflation being a little more persistent than he would like, which helped push bond yields up. Yields moved up despite global economic data starting to decelerate. Germany factory orders were down 7.7% versus the previous month, way below the consensus at -2.2%. Germany is closely tied to China, which remains in the early innings of dealing with its property sector fallout. The last week potentially provided a peek into which way bond yields would go amid rising inflation and slowing growth, with the initial reaction higher.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.