Equities Sell-off on Higher Inflation

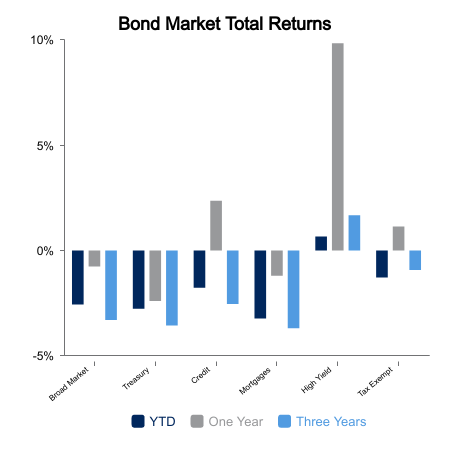

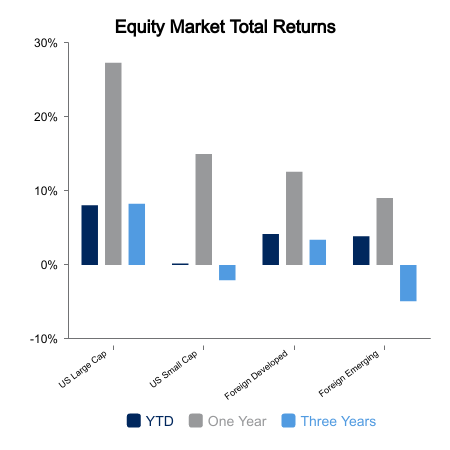

Equities retreated as inflation readings are becoming persistently high. Fed rhetoric is starting to dial back expectations for rate cuts. The S&P 500 ended the week down 1% with the NASDAQ faring slightly better at -0.7%. Small caps fared the worst with a 2.29% drop, which included a 2.5% drop on Wednesday alone. Core bonds were down 1.2% on the week as interest rates moved higher.

The equal-weight S&P 500 has fallen about 3% from its highs, which is where prices traded a month ago. The AI theme was long in the tooth and energy was again the source of funds for sector rotation.

Will the Fed Cut?

The economic data was the focus of attention as investors try to gauge the Federal Open Market Committee (FOMC) reaction function. The Employment report showed that 303,000 jobs were added to the economy in March. This was well above expectations and led to a notable rise in fixed income yields on the day. The unemployment rate ticked down to 3.8%. The unemployment rate is derived from a different survey and has been much weaker than the headline Establishment Survey. This month, however, the Household Survey showed job gains of 498,000.

The Fed has pivoted in recent months to say that job growth can be strong, and inflation can come down. During their rate hiking campaign, they considered job weakness a necessary ingredient to bring inflation sustainably back to 2%. They no longer have this viewpoint and therefore good economic news can be good news for equities, which rallied 1% on the day.

The Consumer Price Index (CPI) report would come later in the week, and it was worse than expected. Core inflation was expected to come in +0.3% and again it was 0.4%. Equities sold off sharply and bond yields surged. We now have three consecutive misses higher with core services inflation now running at an 8% annualized rate over this span. The market now has less than two Fed Funds rate cuts priced in for 2024.

The number of items in the CPI basket up less than 2% has dropped from its peak. More items are up 4% or more, so inflation does appear to have stopped improving. However, much of the surge in core services is from auto insurance annualizing at 27% over the last three months. Hopefully this can at least decelerate in coming months. The core CPI increase was +0.359% and barely got the round up. An overly data-dependent Fed causes ripple effects to where a +0.359% CPI versus +0.344 can materially alter the path of asset prices, especially in the short-term.

|

|

Sources: BTC Capital Management, Bloomberg

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.