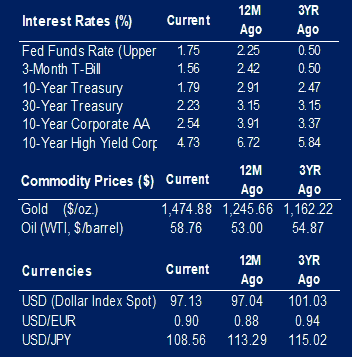

The Federal Reserve rate-setting committee voted unanimously to leave the federal funds rate unchanged. Rate cutting intervention was deemed necessary to offset slowing economic growth toward the end of 2018. The broad expectation is for rates to stay the same for at least a little while. We come to this opinion due to future probabilities of changes in the market. For January, the probability of the rate staying the same is 95.6%. Probabilities of no change stay above 70% up to June 2020. This no change posture is indicative of the expectation of growth in at least the first half of 2020.

We continue to see consumer strength in the United States. The preliminary Michigan Sentiment reading for December is 99.2, which is higher than the expected 97.0 and the previous month’s 96.8. A strong employment landscape has likely contributed to this confidence among consumers. The unemployment rate remains within record-breaking territory at 3.5%. Over the last two years there has been concern that a low unemployment rate will lead to acceleration of inflation. However, we haven’t seen this happen yet. This could be due to previously uncounted workers, or people who had stopped looking for work, coming back into the workplace. This is because people who have stopped searching for employment are not counted in unemployment numbers.

Inflation in November, as measured by the Consumer Price Index (CPI), was at 2.1% year-over-year. This is slightly higher than the expected 2.0% and the previous month’s 1.8%. Core CPI, which excludes food and energy, was up 2.3% year-over-year. This is right in-line with expectations and the reading we saw in October.

Another indicator of consumer strength is consumer credit. This data point, measured by the Federal Reserve, showed a strong increase in October. The general thought is consumers take on more credit when they believe they will be able to pay it off in the future. Credit increased by 5.5% year-over-year in October. Outstanding consumer credit was at $18.9 billion in October. A lot of the growth came from revolving credit, which saw an annual increase of 8.8%. This is a pretty significant change for 2019, only surpassed by July’s gain.

|

|

Contributed by | Kuuku Saah, CFA, Investment Analyst

Kuuku is an Investment Analyst at BTC Capital Management with nine years of investment management experience. Kuuku’s primary responsibilities include portfolio management and analysis. Kuuku attended Drake University and double-majored in finance and economics. He is a holder of the right to use the Chartered Financial Analyst® designation.

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involved risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.