Equities continued to rise last week as virtually all major market indices moved higher. For domestic markets, small-cap stocks led the way as the Russell 2000 Index returned 1.8%. Large-cap and mid-cap stocks also moved higher with weekly returns of 0.5% and 0.8%, respectively. Developed foreign markets matched U.S. small-cap stocks with a return of 1.8%. On a year-to-date basis, it is the MSCI EAFE Index (EAFE) of foreign developed markets that is leading the way with a return of 6.1%. This relative outperformance for international equities is not just a 2023 phenomenon, but one that began in 2022. In fact, over the past three months, EAFE has returned 11.8% while the Russell 300 Index of U.S. equities has delivered a return of 7.3%.

The strong start to the year for foreign equities, particularly European equities, is attributed to a relatively mild winter, which has helped alleviate concerns regarding a prospective energy crisis. Other positive factors include a weakening in the value of the U.S. dollar and stabilization in commodity prices.

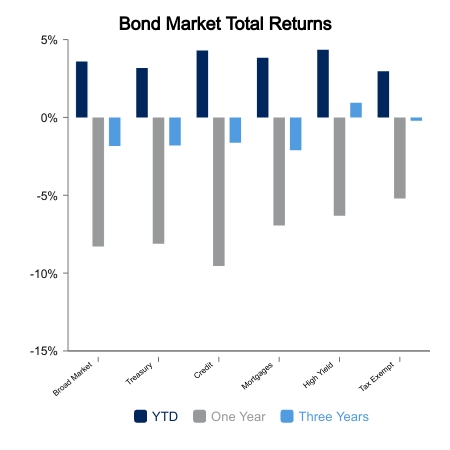

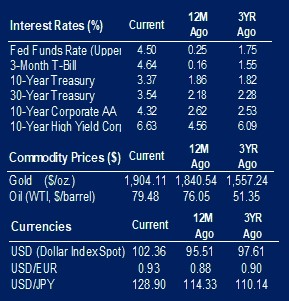

On the fixed income front, bond yields continue to move lower with the 10-year U.S. Treasury issue moving from a yield of 3.54% to 3.37%. As yields moved lower, returns for bonds moved higher as the aggregate U.S. bond market returned 1.3% for the week. Contributing to this positive performance were inflation reports that indicated further moderation with consumer prices and producer prices both continuing their declines from the peak levels seen last year. After hitting a year-over-year peak of 9.1% in June, consumer prices have now decelerated to a year-over-year increase of 6.5%. The decline for producer prices has been even larger as its recent year-over-year level registered 6.2% compared to its recent peak of 11.7% in March 2022.

Economic releases pertaining to the U.S. consumer were mixed. The University of Michigan’s consumer sentiment index rose to 64.6 in the first two weeks of January. December’s reading registered 59.7, and the consensus estimate for the period was 60.4. Contributing to the improvement was a reduction in energy prices and improved conditions from the financial markets. In contrast to this positive news was the report of December retail sales, which showed a decline of 1.1%, the largest monthly decline in 2022.

On the positive side of the economic ledger was a higher-than-expected reading for the NAHB Housing Index, which snapped a streak of 12-consecutive monthly declines.

|

|

Source: BTC Capital Management, Bloomberg LP, FactSet, Refinitiv (an LSEG company).

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.