Sustained Volatility

Market participants have been attempting to read the tea leaves, trying to ascertain positioning in the face of a very fluid macro-environment. One thing that has remained elevated is volatility.

The CBOE Volatility Index, or VIX, currently stands at 26 which is above its historical average of 19.6. This is a measure of constant, forward 30-day expected volatility of the U.S. stock market, derived from the intra-day pricing of call and put options on the S&P 500.

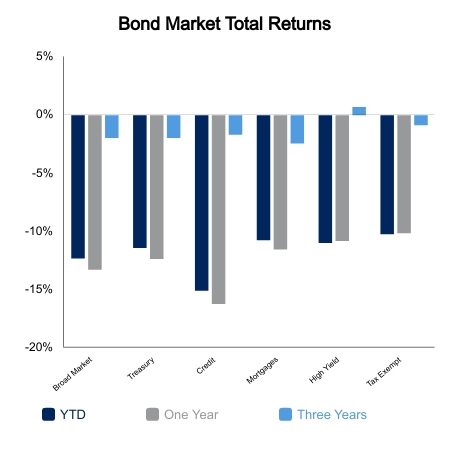

A similar measure for bond volatility is the Merrill Lynch Option Volatility Estimate Index, or MOVE, which measures U.S. interest rate volatility implied by options on various Treasury securities. While off its June 28 high of 156.1, at 125.4 this measure also supports the theme of sustained, near-term volatility.

Macro Events

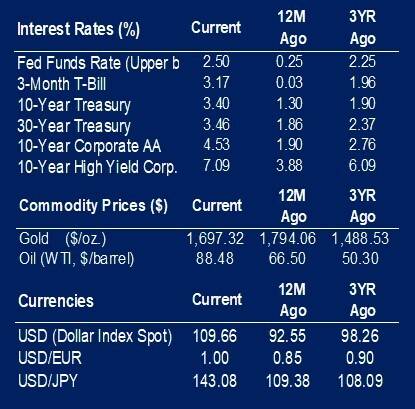

This past week markets were rocked by the Consumer Price Index (CPI) for August. Recent consensus had been that inflation had peaked. The Fed stood ready to raise its target range by 75 basis points at their upcoming meeting on Sept. 21. The year‑over‑year report of an 8.3% increase in CPI exceeded consensus expectations of 8.1%. Markets questioned whether this CPI print may motivate the Fed to exercise a more drastic rate increase of 100 basis points in their ongoing efforts to combat inflation.

This caused the yield on the U.S. Treasury 10‑year to rise to 3.4%; the yield on the 10‑year stood at 3.3% at the close of last week.

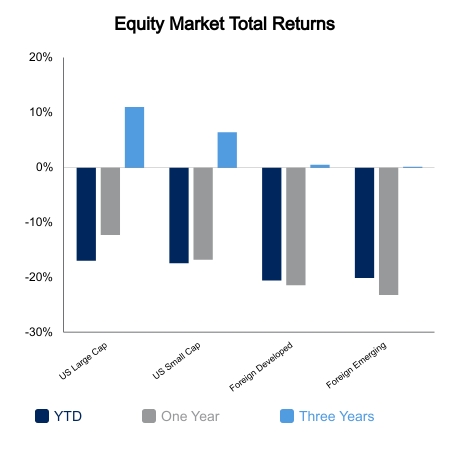

The Russell 3000 Index fell 4.3%. Currently this index has declined 16.9% year‑to‑date through yesterday’s close. Even foreign stocks were not immune as the MSCI ACWI ex‑USA Index fell 1.5%, furthering its year‑to‑date decline of 19.2%.

Hourly earnings for August were also reported, increasing year‑over‑year by 5.2%. Household income has lagged increases in inflation. Yet consumers appear to be spending as Retail Sales for August increased month‑over‑month by 0.3%, improving on the contraction of 0.4% exhibited in July. When considering the Retail Sales Control Group (which estimates sales at retail and food services stores and inventories of retail stores excluding items like gasoline, motor vehicle and building materials) the month‑over‑month spend rate was flat. Note that Retail sales ex-Autos contracted during August.

The Near-Term

It appears the path of least resistance, as indicated by the VIX and MOVE indexes, supported by the rise in yields and recent declines in equity markets, is to not fight the tape. Interestingly, concerning equities, as presented in our September Five in Five, the ratio of the S&P 500 P/E (TTM) to the VIX index appears to indicate excessive risk aversion. In other words, opportunity may be presented when all are running to the exits.

|

|

Source: BTC Capital Management, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.