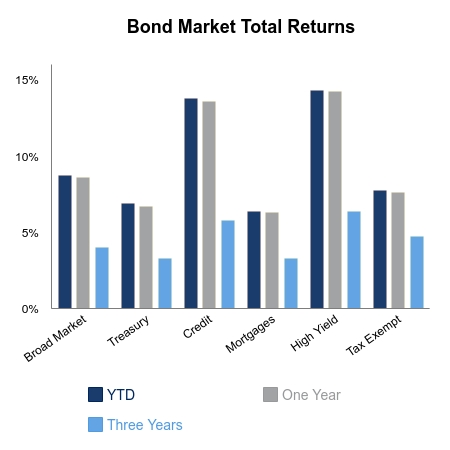

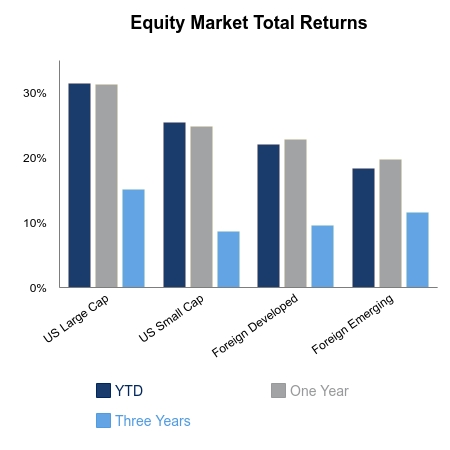

Equities posted strong returns for the month of December with the S&P 500 up 3.0% and emerging market equities up 7.4%. For the year, the S&P 500 gained 31.5%, which bettered small caps by roughly 6%. Foreign equities posted good gains, but lagged the U.S. market by 8-12% depending on which benchmark is used. The robust equity gains were also coupled with strong fixed income returns. The Bloomberg Barclays Aggregate Bond Index gained 8.7%, and combined with the performance out of equities, created exceptional returns in mixed allocations.

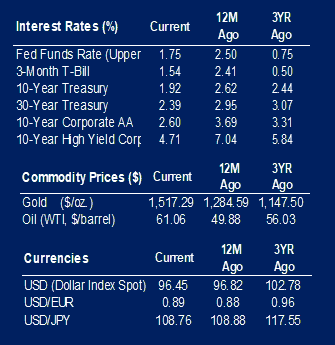

If one remembers back to the end of 2018, the key takeaway was nearly every asset class posted a negative return. Bonds managed to rally late to finish with a 0% return, but didn’t provide the necessary diversification. According to Deutsche Bank, 2018 was the worst ever, going back to 1900, regarding the percentage of asset classes posting negative returns. In 2018, 90% of asset classes posted a negative return. The final numbers aren’t out yet for 2019, but it will likely be the complete opposite with nearly all assets posting gains. Two popular asset classes, gold and high-yield bonds gained 18% and 15%, respectively.

A common message coming from the mainstream narrative is the notion of profit taking. This is not a prescription for success as long-term investment returns are built on the backbone of compounding rather than the performance in a single year. While 30% returns are not normal, one must realize this followed a year of declines. The Dow Jones Industrial Average posted a two-year price return, which excludes dividends, of 15%. Going back to 1900, the current two-year price return is surprisingly below the historical median and within 1% of the 120-year average.

Looking forward to 2020, there is an uncanny correlation between the performance of the equity market on the first two days of the year and how the entire year will transpire. This is also true regarding the month of January. Therefore, it bears close monitoring to see how equity markets start the year. Many prognosticators are calling for a near-term market top, related to tax selling getting pushed into 2020 instead of last year. Even though most sentiment gauges are very high, market participants continue to find ways to be cautious. Caution is not usually present at secular market tops and thus, 2020 may be shaping up to be another strong year for equities.

|

|

Contributed by | Justin Carley, CFA, Managing Director

Justin is a Managing Director, providing portfolio management and credit analysis for fixed income strategies. He also manages the firm’s multi-manager portfolio strategies and contributes to the asset allocation framework. Justin has more than 10 years of experience focusing on management, analysis and trading of fixed income portfolios. Previously, Justin was a fixed income portfolio manager at American Trust & Savings Bank. Justin has a bachelor’s degree from Truman State University, holds the Chartered Financial Analyst designation and holds a Fellowship in the Life Insurance Management Institute.

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involved risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.