Economic data was at the forefront this week as current readings of inflation and employment were released. On the employment front both continuing jobless claims and initial claims were higher than anticipated. While labor markets continue to exhibit resilience these readings along with the recently announced decline in the JOLTS measure of job openings are creating a narrative of moderating strength in the labor market. This moderation could prospectively ease inflationary pressure in terms of decreasing upward pressure on wages. Also, while the unemployment rate did decline slightly versus the prior month’s reading the increase in payrolls was less than forecast.

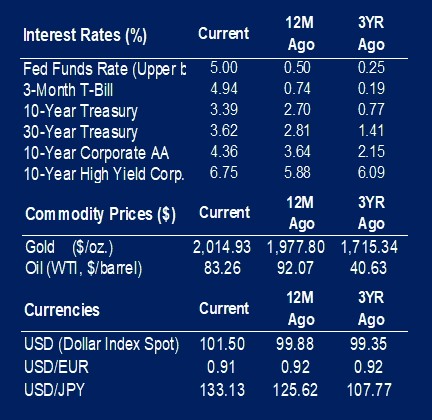

And as for inflation specifically, the Consumer Price Index (CPI) was lower than forecast for both the month-over-month and year-over-year periods. While the annual level of 5.0% continues to be markedly higher than the Federal Reserve’s target of 2.0%, this month’s reading represents continued movement toward the desired level. A key contributor to this month’s lower reading was a decline in the energy component of the CPI as both gasoline and fuel oil were lower year-over-year. This impact of lower energy prices may prove to be temporary as recently announced production cuts by OPEC start to work their way into fuel prices. In fact, the price of a barrel of West Texas Intermediate crude has risen from $75.68 on March 31 to a current level of $83.26.

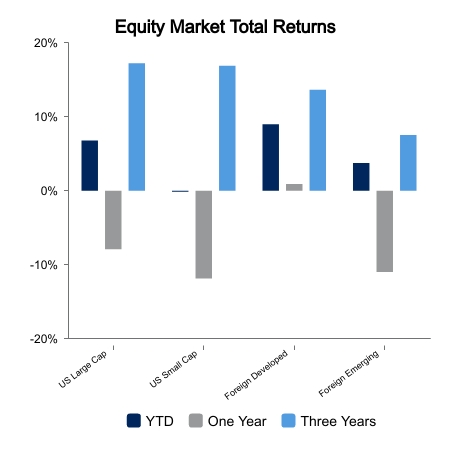

U.S. stocks were essentially flat over the past week as the Russell 3000 Index returned -0.2% for the period. Value stocks which have lagged their growth counterparts on a year-to-date basis enjoyed a victory for the week as they rose 0.9% compared to a decline of 1.1% for the growth side of the ledger. Small cap stocks also experienced a positive result for the week returning 0.3%. The strongest performance for the week came from outside the U.S. as the EAFE Index of developed markets returned 1.3%.

Investors will begin focusing on first quarter earnings later this week. While results for first quarter will be scrutinized closely, the outlook communicated by company executives will be a key driver in near term stock price movements.

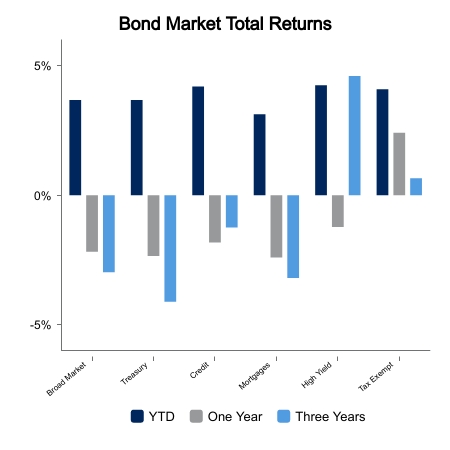

Bonds declined over the week with broad aggregate indices returning -0.5%. An increase in interest rates drove the negative return as the 10-year U.S. Treasury saw its yield rise from 3.31% to 3.39%. Much of the move higher in rates occurred in response to last Friday’s employment report which showed that, although strength in the job market is moderating, it is still sufficiently strong enough to warrant another increase in the Fed Funds rate when the Federal Open Market Committee meets early next month.

|

|

Source: BTC Capital Management, Bloomberg LP, FactSet, Refinitiv (an LSEG company).

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.