Equities Hold up as Earnings Season Heats Up

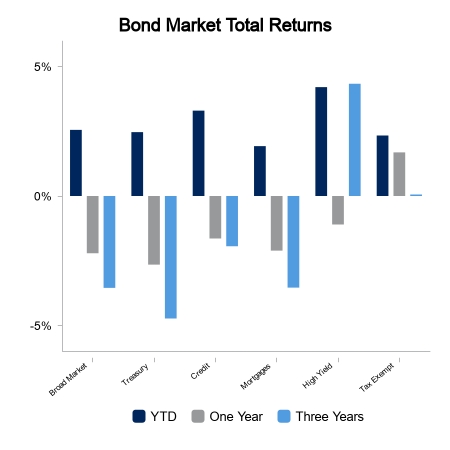

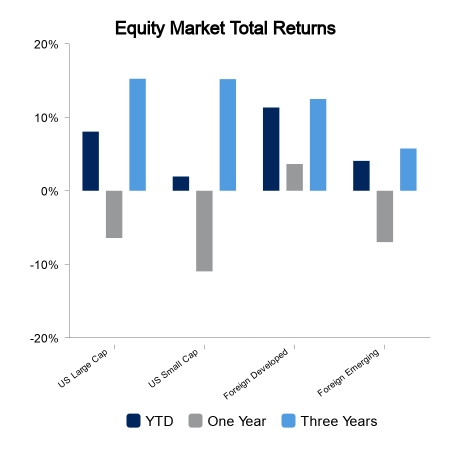

Equities advanced on the week as better than expected economic data helped lift sentiment. Domestic indices continue to outpace foreign markets as the S&P 500 advanced 1.6% to notch its highest weekly close of the year. The NASDAQ continues to lead with a weekly advance of 1.9%. Bond yields moved higher on the week as core bonds lost 1.1%.

Mixed Picture

Economic data came in better than expected. Retail sales were expected to be weak but came in better than forecast. This helped lift equity sentiment and sent bond yields higher on the day. Data from China continues to come in above expectations and lift global sentiment. Liquidity data out of China is robust and is a tailwind to equities. China reported GDP and retail sales this week that exceeded expectations.

Earnings season has been a focus point with mixed results. Early results have come in better than expected although this only compares the last estimate and not expectation from the beginning of the quarter. Forward earnings estimates have been coming down for several months.

Regional bank equities have had mixed results thus far; however, the mega banks had a great week. JP Morgan had its second-best earnings day performance in at least 20 years with a 7.5% gain on the day. Also getting attention in the market is the lack of breadth during this recent run-up. Fewer stocks are contributing which can be a bearish signal, although not always. For example, the S&P 500 had its highest weekly close of the year, but in February there were 37 stocks at a 52-week high versus 28 this week.

Rumor Mill

Next week brings the Bank of Japan (BOJ) meeting where there will be a new governor for the first time in a decade. One BOJ watcher is out with some bold speculation that the new governor is poised to hike rates imminently, which would be a shock to markets. The theory is like the 1987 film “Wall Street.” Last week a 90-year-old Warren Buffett flew to Japan and announced an increase in his ownership of Japanese trading house securities. It is speculated this was his first flight to the country in more than a decade. He never visited when he made the initial investment and these stocks have been huge successes. Is the new BOJ governor the reason? Traders are always looking for an edge in the market, or at the least the hope of an edge. Some use satellite images, others use the old-fashioned plane destination.

|

|

Source: BTC Capital Management, Bloomberg LP, FactSet, Refinitiv (an LSEG company).

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.