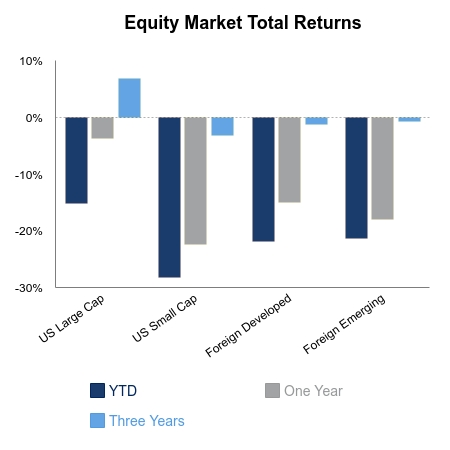

Equities were up sharply on the week as the S&P 500 gained 11.4%. Small caps were also up 11%, while beaten up industries had some big gap ups in prices. Treasury yields were higher at the back end of the curve as investors begin thinking about virus sanctions being lifted. The COVID-19 news flow is more positive at the margin and this has helped equities rally more than 20% from their lows.

Economic data is starting to get ugly, but everyone knows this, so there is little predictive power in the numbers. Jobless claims put in back-to-back weeks of 6.6 million following 3.3 million during the first weekly spike. Retail sales are expected to be up in March according to Bank of America thanks to a huge spike in food sales, but credit card usage has fallen off a cliff. Bank of America debit and credit card data is showing a drop in March that is three times the largest drop in 2008. Earnings season is getting underway. Thus far, most companies are reporting weak results and withdrawing guidance. The stocks are generally holding up after results as a negative catalyst is removed, which allows traders to re-enter positions.

Last week may have been the peak in doomsday forecasts. Wall street was in a race to see who could publish the lowest GDP forecast. The United States was supposed to be entering the worst of the situation and with it came all the scare headlines. It was no surprise markets would have a huge rally as it was almost impossible to have the rhetoric turn worse. Just a marginal improvement in tone sent equities surging.

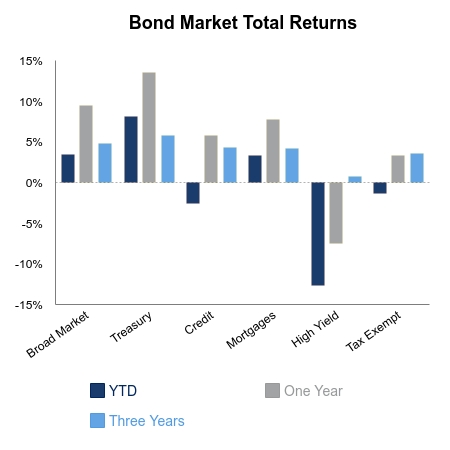

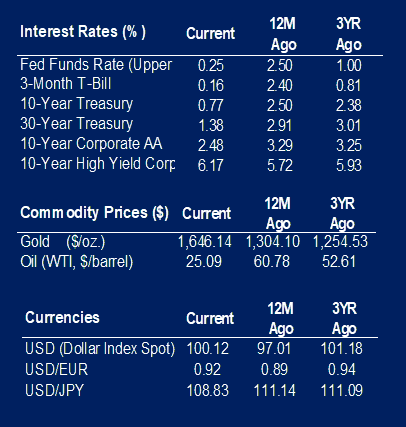

The Federal Reserve (Fed) continues to roll out programs to aid the situation. Some appear to be working as Treasury markets are functioning better. Corporate bond spreads are tightening for those deemed to be survivors. Corporate bond supply has surged as companies look to raise cash when they can, not when they must. Previously the Fed said they would buy investment grade bonds that met certain criteria. Today they announced they will buy bonds that were downgrade to high-yield after March 22 and buy high-yield exchange traded-funds. They are also expanding into other areas of the market. Some expected this to happen eventually, but to see it implemented (with risk assets rising) demonstrates a more preemptive mindset.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involved risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.