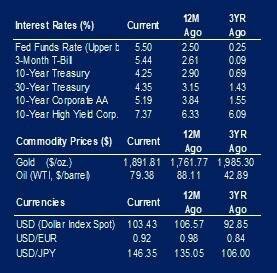

Inflation data was at the forefront of this week’s economic data releases. The Consumer Price Index (CPI) readings came in at levels that were in line with, or better than, expectations. With its year-over-year reading of 3.2% the CPI is just a little over one-third of the peak rate of 9.1% that occurred in June 2022. Producer prices came in a little stronger than anticipated with a reading of 0.8% compared to an expected reading of 0.7%.

Also, this week consumers continued to demonstrate their resilience as retail sales for July were much stronger than anticipated. For economists forecasting a recession, consumer strength has been confounding. This is due to evaporating excess savings from pandemic related relief programs and the upcoming end of the moratorium on student loan repayments.

Another reflection of consumer confidence was the latest report on housing starts which rebounded from a decline in June to an increase of 3.9% for July. Building permits held steady in July, virtually unchanged from the level seen in June.

Two other indicators released this week showed better than expected results. Industrial production +1.0% and manufacturing production +0.5% were both higher than expected.

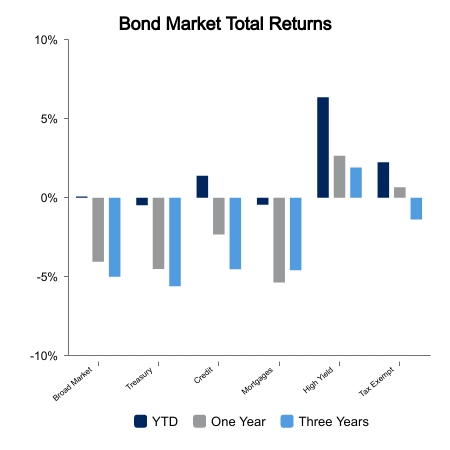

Fixed income was impacted by numerous factors this week that led to a negative return of 0.6% for the period. Driving the negative return was an increase in interest rates as evidenced by the yield on the 10-year U.S. Treasury issue which ended the week at 4.25%. This is the highest yield for the 10-year since 2008.

Included in the factors impacting bonds were the waning expectations of an imminent recession, a heavy issuance calendar of Treasury security sales and the Federal Reserve governor’s comments indicating that they may execute additional Fed Funds Rate increases.

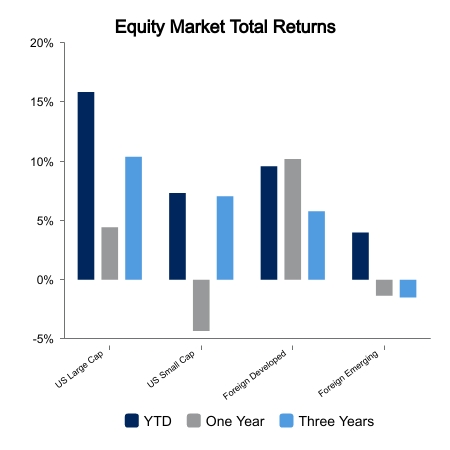

Equity investors also experienced a negative return for the week. For U.S. investors, equities, as measured by the Russell 3000 Index, had a return of -2.2% for the week. And both growth and value segments of the market had negative returns exceeding 2.0%. Small cap stocks fared even worse for the week as the Russell 2000 Index declined by 3.8%. International equities as measure by the MSCI EAFE Index also declined, returning -1.4%. The decline in equites is not totally unexpected given the extraordinarily robust performance they have delivered year-to-date.

|

|

Source: BTC Capital Management, FactSet, Refinitiv (an LSEG company).

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.