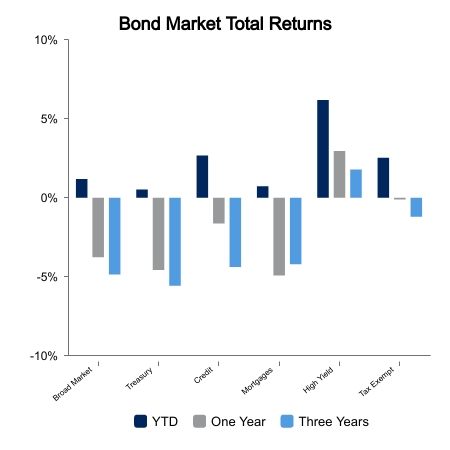

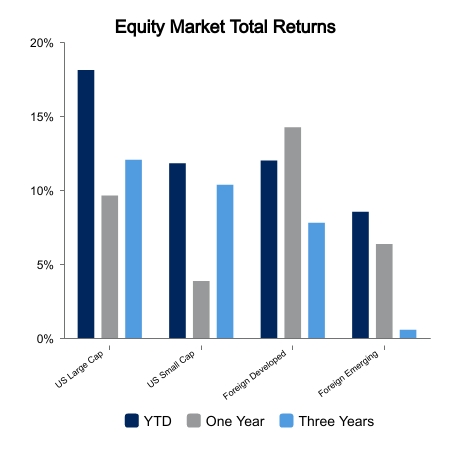

Over the last week, both bonds and equities exhibited negative returns. Bonds declined 1.2% while equities also retreated. Within the U.S., small caps declined 0.7% while large caps retraced 1.2%. Outside the U.S., emerging markets fell 1.1% while developed markets retreated 2.0%.

Earnings Roundup

Earnings season for the second quarter is winding down. According to Refinitiv, 334 companies within the S&P 500 have reported. Approximately 80% have beat analysts estimates, while 16% missed. Within the Information Technology sector, 94% of the companies which have reported have beat estimates. Similarly, both Health Care and Consumer Staples have, so far, exhibited beats of 92% and 91%, respectively. To date, earnings for the second quarter have declined 6.6% year‑over‑year (YOY). With 166 companies yet to report, analysts’ currently estimate a YOY decline of 5.4% in earnings of the S&P 500.

A Downgrade of U.S.

On Tuesday, Fitch Ratings “downgraded the United States of America’s Long-Term Foreign-Currency Issuer Default Rating (IDR) to ‘AA+’ from ‘AAA’. The Rating Watch Negative was removed, and a Stable Outlook assigned.”

Fitch communicated their downgrade, “reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to ‘AA’ and ‘AAA’ rated peers over the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions.”

Market reaction to this downgrade has yet to play out. Recall the market reaction precipitated after S&P initiated a similar action in August 2011. The S&P 500 dropped 4.8% after the announcement. It then waddled its way through various downturns culminating in an overall decline of 5.5% during that month. It then went on to decline by 7.0% in September 2011.

On the Economic Front

- Last Thursday the Bureau of Economic Analysis (BEA) released its “Advanced Estimate” of 2nd‑quarter 2023 real gross domestic product, which increased at an annual rate of 2.4% versus consensus estimates of 1.5% and the 2.0% increase of the first quarter.

- The BEA also reported Core Personal Consumption Expenditures increased 0.5% month‑over‑month during June, which exceeded the 0.2% rise in May. Separately, the BEA reported a 0.3% increase in Personal Income for June, below both consensus estimates and May’s 0.5% increase.

- Manufacturing Purchasing Managers’ Indexes for July across the globe were reported, with all regions exhibiting measures below 50 (in contraction). Within the U.S., Markit and ISM reported levels of 49.0 and 46.4, respectively.

- Thursday will bring reports on Productivity, Durable Goods, Factory Orders, Markit and ISM Services, while Friday will see the report on the employment situation for July. Stay tuned.

|

|

Source: BTC Capital Management, FactSet, Refinitiv (an LSEG company).

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.