Will The Most Anticipated Week of the Quarter Push Equities Higher or Lower?

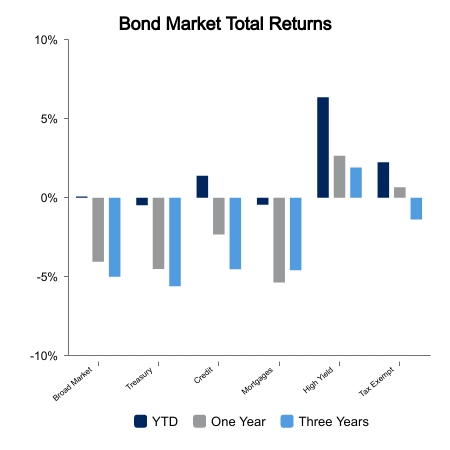

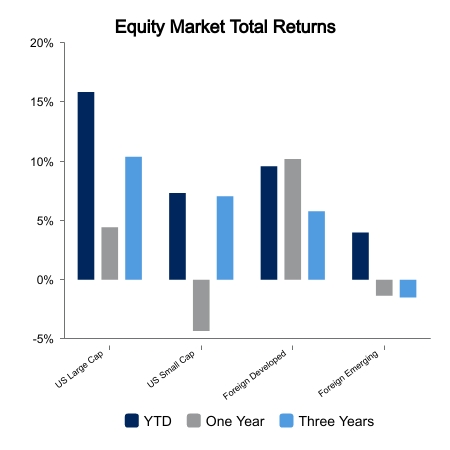

Equities stabilized this week following much weaker global Purchasing Managers’ Index numbers. The weak economic data was treated as good news due to a sharp drop in Treasury yields. The NASDAQ led with gains of 1.8% while small caps were down slightly. Foreign equities were also down on the week, taking their cues from persistently weak Chinese economic data. Core bonds were up 0.6% despite the 10-year Treasury trading at its highest yield since 2007.

All Eyes on NVIDIA and the Fed

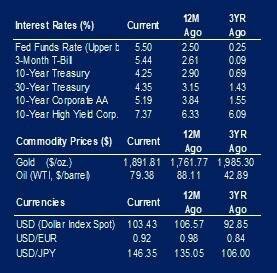

This week has been anticipated for quite some time and is being dubbed as one of the most significant of the year. This is due to NVIDIA earnings and Jerome Powell’s speech at the Kansas City Fed Jackson Hole Symposium this Friday. The week got started with a Wall Street Journal piece noting that Powell could hint at a higher long-run neutral rate of interest. The Fed hasn’t raised their long-run neutral rate of interest in years and doing so would be a major shock to markets. Despite raising interest rates substantially higher than initially expected, the Fed dots always showed interest rates returning toward a long-run Federal Funds rate of 2.5%. This implies 2% inflation and a 0.5% real rate, dubbed r-star.

NVIDIA results were hyped as much as possible, given it is the AI darling stock. Most AI-related stocks have already rolled over and put in a sizeable distance between their current price and 52-week high. But not NVIDIA, it was the one true AI stock and hit a 52-week high this week. Results came in better than the most optimistic forecast and caused some gasps on CNBC. The future is here. The stock popped 10% right after the release. It was supposed to be the catalyst to push markets back into positive sentiment.

The 10% pop for NVIDIA has fallen to just 2% as of this writing. The semiconductor sector has gone from up more than 3.5% yesterday evening to down more than 1.5% this morning. The broader NASDAQ 100 was up 1.5% in early trading today, but this has reversed to down almost 1.5%.

This could be a bad omen for markets. But events like this have happened in the past when the calendar was stacked. Plenty will want to remain hedged for Jackson Hole tomorrow, so early euphoria is fading as hedges remain or get added. Chasers get stopped out and markets reverse quickly. But if Jackson Hole fails to crack markets, then hedges can come off and equities could potentially put in a strong consecutive day advance.

|

|

Source: BTC Capital Management, FactSet, Refinitiv (an LSEG company).

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.