The big headline this week was the GDP growth miss. GDP was expected to grow by 8.5% this quarter, however actual growth came in at 6.5%. Decreased federal government spending in the quarter slowed overall growth. Private inventory investment and residential fixed investment also contributed to the slower than expected growth. Economic areas that have seen the most growth were personal consumption expenditures, nonresidential fixed investments, exports and state and local government spending.

Personal income in June was higher than analyst estimates. A dip of 0.5% was expected, but there was an increase of 0.1% instead. The increase in personal income was primarily because of higher private wages. A decrease in government programs slowed growth here.

Personal Consumption Expenditure (PCE) came in hotter than expected at 1% in June. PCE is a measure of inflation. The expectation was for an increase of 0.6% and the year-over-year number is at 4%. The increase reflects growth in the consumption of goods and services. In goods, a strong increase was recorded within nondurable goods, however growth in durable goods was slower. There was strength across the board in services.

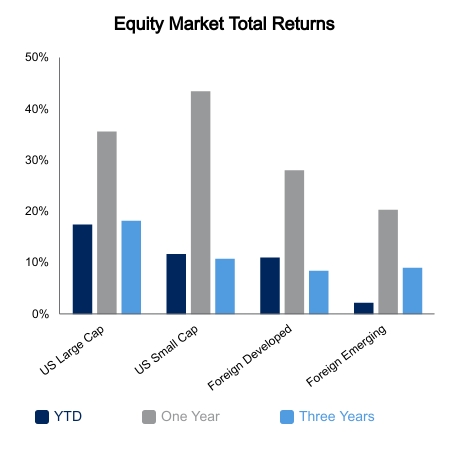

As of yesterday, 75% of the S&P 500 companies had reported earnings. On the earnings front, results were 16.1% better than expected with growth of 91%. Growth in earnings was led by the Industrials and Consumer Discretionary sectors. Companies in the index grew sales by 22.9%, which is 4.6% better than expected.

The strong earnings reports are not yet positively impacting the markets in a significant way, as much of the growth was expected. Another reason market performance was muted this week is due to concerns around increasing COVID-19 cases. We have seen a slowing of the reopening trade as the CDC began recommending masks indoors again, even for those who are vaccinated. At this time, mass shutdowns are not expected. However, there could be some slower than expected growth for travel, restaurants, hotels and traditional retail. Over the one-week period, the S&P 500 Index stayed flat at 0.07%.

Pending home sales were down in June by 1.9%. This comes after a gain in May. High home prices have been blamed for the decrease. Currently, the Midwest region offers the most affordable prices.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.