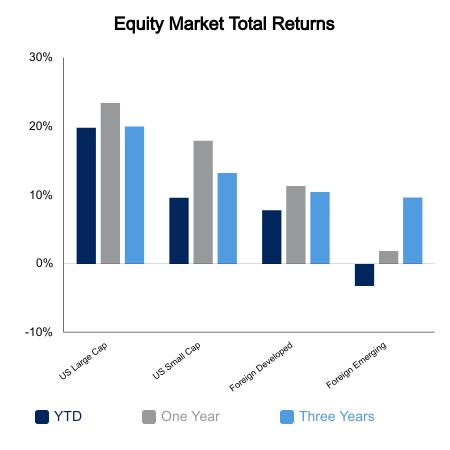

Equity markets took a sharp drop this week, which was kickstarted by the worst Black Friday return ever. New virus concerns didn’t help things nor did hawkish remarks from Federal Reserve Chairman Jerome Powell when testifying before the U.S. Senate Banking Committee. The S&P 500 dropped 4% on the week. Large cap technology was the big relative winner as the NASDAQ dropped 2.7% compared to the 7.9% drop in the Russell 2000. It is often said the best signal is a failed signal, and the Russell 2000 sure did follow this roadmap. After breaking out of a nine-month range in November, the index has fallen more than 12% from its November intraday high. The Bloomberg Barclays Aggregate Bond Index at least exhibited the preferred correlation by posting gains of 1.0% on the week.

The S&P 500 is down 4.1% from the peak, but there is serious damage being done to the median stock. The index is being held up by strong relative performance from the heavy weights. The S&P 500 is 5% above its 200-day moving average whereas the Value Line Geometric Index, a proxy for the median stock, is 4.4% below its 200-day moving average. The NASDAQ is down 5% from its high, yet only 10% of the stocks in the index are within 5% of their 52-week high. 66% of the members are down 20% from their 52-week high.

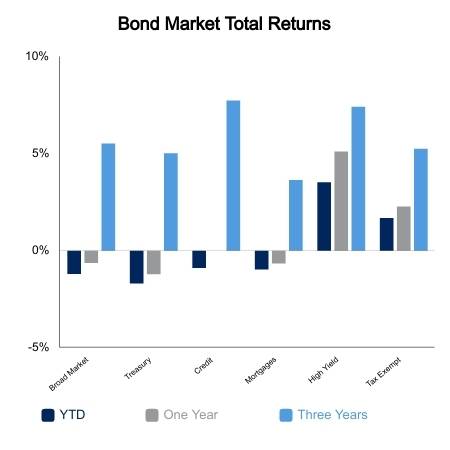

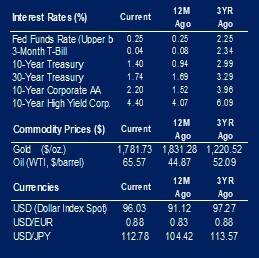

The yield curve via the 5-year versus 30-year is flattening in one of the more rapid moves over the last 20 years. The 30-year Treasury is saying unequivocally that inflation is transitory in the monetary sense. Yields lead inflation, not the other way around, and the current bout of inflation is driven by temporary factors that may persist for longer than desired, but ultimately will not be a lasting contributor to inflation for years to come. Countries continue to default to lockdowns upon virus news, moderate Democrats have shown apprehension to further stimulus considering high Consumer Price Index readings, and Jerome Powell noted this week that the Federal Open Market Committee should discuss speeding up taper to make room for rate hikes. The three big reaction functions are all pointing toward growth inhibiting policy, thus the 30-year Treasury ended the week with a yield of 1.74%, its lowest since January.

The ADP employment report showed a gain of 534,000 jobs, which gives an early read on the Bureau of Labor Statistics Employment report that comes out this Friday. At this point it is tough to tell whether the equity market wants a strong number, which reinforces rate hikes, or a weak number to get the Fed to pivot more dovish.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.