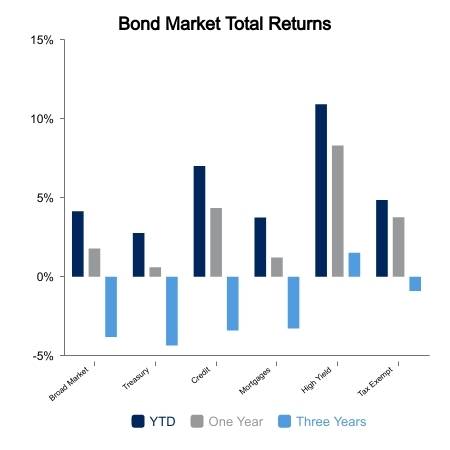

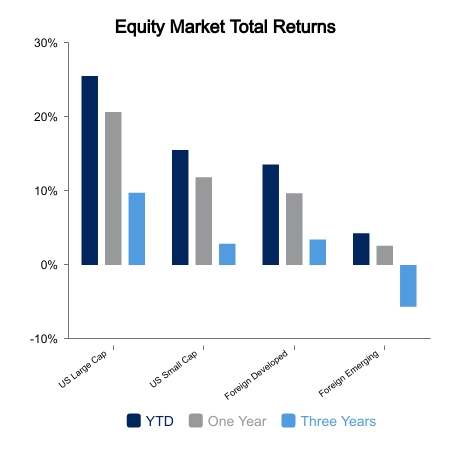

For investors, gift giving has come early this year as the financial markets provided a strong level of returns this week. Fixed income investors saw a return of 1.0% for investment grade bonds as the yield on the 10-year U.S. Treasury fell from a level of 4.11% to 3.92%. This represented the first time since August that this bellwether of the bond market saw its yield below 4.0%. For equity investors the gift was even more impressive as domestic indices generated returns in a range of 3.2% to 5.0%. While small cap stocks, as measured by the Russell 2000 Index, have lagged their large cap counterparts on a year-to-date basis they have come alive of late, returning 7.7% on a month-to-date basis. And in an indication of improved market breadth, returns for the week saw little difference between the growth and value segments of the market. The festive mood seen domestically did not carry over to foreign markets however as the MSCI All Country World ex USA returned a very modest 0.4% for the week.

Consumer and Producer Inflation Data

A variety of economic data releases and Federal Reserve (Fed) commentary helped to propel U.S. financial markets higher. On the economic front, updated figures for both the Consumer Price Index and Producer Price Index were released. On the consumer front, inflation data came in as expected on a year-over-year basis at 3.1%. On the producer side, the year-over-year came in slightly lower than estimated with a year-over-year result of 0.9%.

Fed Funds Rate Commentary

The commentary from the Fed came in the form of an updated policy statement that accompanied their announcement that they were maintaining the current level of the Fed Funds rate. Fed Chair, Jerome Powell, provided additional commentary at his post-announcement press conference. In the policy statement the Fed used language that suggested that further increases to the Fed Funds rate may not be needed. In his press conference Chair Powell backed away somewhat from the “higher for longer” strategy to one of not keeping the Fed Funds rate “too high for too long.”

Consumer Credit

Other positive pieces of economic data released this week included a smaller than expected increase in Consumer Credit. The increase was less than forecast and less than half of the prior month’s reading. This lower reading is attributed to a belief that tighter lending standards and higher interest rates are contributing to a slowing of credit growth. Interestingly the level of credit card debt being serviced by consumers represents a lower share of household income than it was prior to the COVID pandemic.

Consumer Sentiment

Lastly, the University of Michigan Sentiment Index rose sharply in part due to a lowering of inflation expectations by consumers. The survey revealed that consumers’ one-year outlook for inflation fell to 3.1%, the lowest level since March 2021.

|

|

Source: BTC Capital Management, Russell 2000 Index, Consumer Price Index, Producer Price Index, The University of Michigan Sentiment Index

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.