Stock Rally Broadens as the S&P 500 Closes in on Record Highs

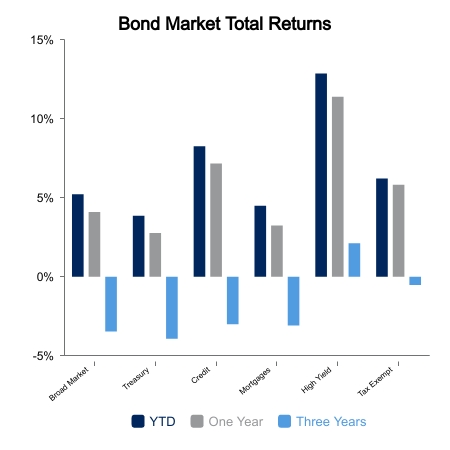

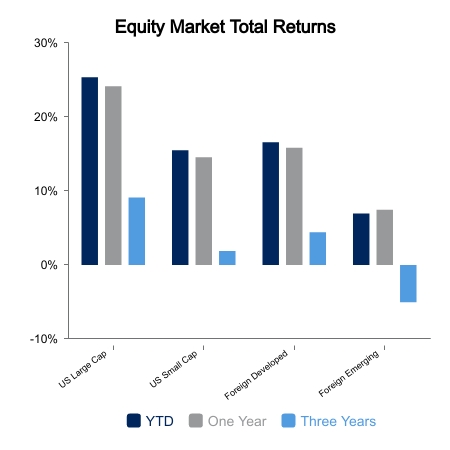

Equities finished flat on the week due to a sharp selloff on Wednesday that erased the prior four days of gains. The S&P 500 finished down 0.1% while the NASDAQ was up 0.3%. Small caps continued to shine with gains of 1.9%. Yields moved lower, which generated a 0.9% gain in core fixed income indices. The S&P 500 has reached rare territory in relation to 14-day momentum readings, and over the last two months the index is up nearly 12%.

This has set a very cautious tone among participants, but history would suggest otherwise. If the S&P 500 finishes the calendar week in positive territory, it will be its eighth consecutive weekly gain. The forward six-week return following an eight-week winning streak has been positive 17 times in a row.

Those concerned with weak market participation and gains only from the “Magnificent Seven” are forced to find other risks now that the Russell 2000 has gone from a 52-week low to a 52-week high at the fastest pace in history. The Index gained more than 22% and went from low to high in just 33 trading days. Not to be outdone, the equal-weight S&P 500 also achieved the same record over the same 33 trading days.

The Fed and Fiscal Put

Economic data was generally favorable with retail sales coming in better than expected. Initial jobless claims have dipped again toward 200,000. The bears on the economy claim there is some “under the surface” job layoff feedback loop already in motion. It must be to support their case because with equities at all-time highs, financial conditions easing and generally favorable forward capital expenditures plans, it is hard to foresee a negative economic sequence starting now.

Some Fed officials sought to somewhat minimize the rate cut expectations after the latest Federal Open Market Committee (FOMC) meeting. This causes some to think the equity market is at risk if the FOMC doesn’t deliver the cuts, but this is too simplistic. The market is forward-looking and a complex system. Earnings and liquidity play a huge part, as does the fiscal and monetary reaction function. The data is less important than the policy response to the data.

The equity rally was ignited partly due to the Treasury issuing an outsized amount of Treasury bills to take the pressure off rising interest rates at the long end of the curve. This month we got new federal legislation that aims to further provide housing subsidies. Just this week, FOMC official, Bostic, said the 2% inflation target isn’t etched in stone. The reaction functions certainly appear supportive should things get bumpy.

|

|

Source: BTC Capital Management, Russell 2000 Index, S&P 500, NASDAQ

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.