Purchasing Manager Index (PMI) numbers for November were released this week. The positive momentum from last month continued into November. The reading of 58.6 for the PMI Composite indicates the economy continues to expand. October’s number was 57.9. The PMI is a diffusion index and numbers over 50 are considered positive indicators.

In November, the unemployment rate dropped to 6.7%, which was 0.10% better than expected and down from 6.9%. This drop shows recovery continues.

According to the Nonfarm Payrolls Report, 245,000 jobs were added. The number shows a slowing in the addition of jobs, the expectation was for 482,500 jobs to be added. The lower than expected number comes on the heels of increasing COVID-19 infection rates. Some communities are reinstating lockdowns and increasing restrictions on gatherings.

Hourly earnings grew over the month by 0.30%. The expectation was for growth of 0.10%.

Final numbers for Durable Goods Orders were released this week and the 1.3% increase remains the same. The increase was led by growth in transportation equipment.

Consumers took on less debt than expected in October. The Consumer Credit number for the month was at $7.2 billion, compared to the expected $17 billion. September’s number was $15 billion. October’s reading shows annual growth of 2%. The growth reflects an increase in nonrevolving credit, up 4.8%. Nonrevolving credit makes up over 70% of consumer credit. Revolving credit on the other hand was down 6.7% over the year.

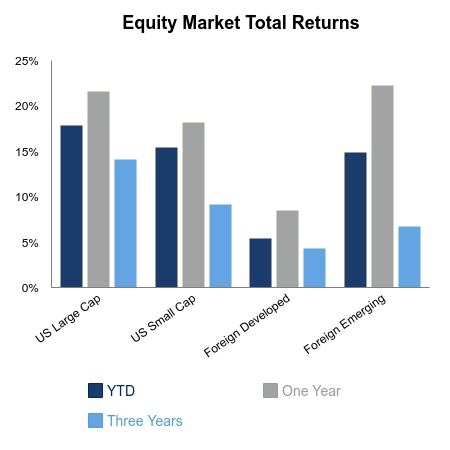

Equity markets reached new highs this week with the S&P 500 Index at 3702.25 on Dec. 8. Despite this high, performance for the week was flat at 0.14%. The Energy sector recorded the strongest performance for the week. However, Utilities and the Communication Services sectors were a drag on performance. The S&P 500 Index closed yesterday up 15.68% for the year. Apparently, equity markets are confident of light at the end of the tunnel. The year-to-date performance has been led by the Information Technology and Consumer Discretionary sectors.

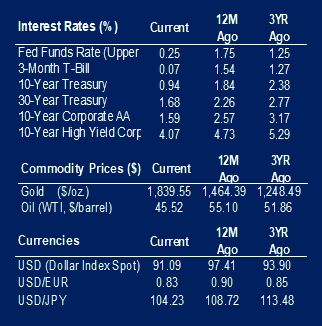

In a somewhat surprising move, OPEC announced an oil production increase of 500,000 barrels a day starting in January. The expectation was for an extension of production cuts. Oil markets reacted positively to this news with the commodity trading up. Demand for oil is expected to increase as the economic landscape improves.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.