Market Overview

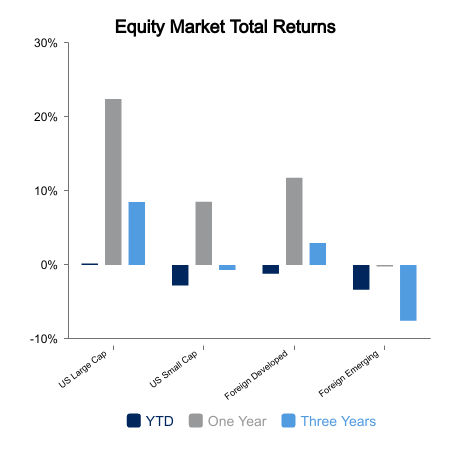

Over this past week, U.S. equities advanced 1.7%, while foreign equities rose 0.3%. Bonds declined 0.5% over the week, which reflected the near-term trend in yields. According to FactSet, the yield for the U.S. 10-year Treasury retraced to 4.0% from 3.9% a week ago.

Survey Says…

Markit, an S&P Global company, released its final Purchasing Managers’ Index (PMI) Services survey for December 2023. According to Markit, December posted a reading of 51.4, which was in line with expectations (note a reading above 50 indicates expansion; a reading below 50 indicates contraction). Markit reported services “… signaled a quicker expansion in activity at the end of 2023,” driven by stronger demand and a rise in new orders, which enhanced overall confidence by business managers.

Markit’s broader PMI sector measure, which considers both U.S. manufacturing and services, exhibited the lowest report since January 2023, as only two of seven sectors measured registered increases during December. Health care displayed the best expansion since April 2023. Financials, driven by an increase in overall business activity, exhibited the quickest upturn since April 2022.

The employment situation remained unchanged for December. According to the Bureau of Labor Statistics (BLS), the unemployment rate remained at 3.7%, while non‑farm payrolls increased by 216,000, exceeding consensus estimates of 160,000. BLS reported continued increases in government, health care, social assistance and construction. Job losses occurred in both transportation and warehousing. Additionally, average hourly earnings for private non‑farm employees payrolls rose 0.4% in December. For calendar year 2023, average hourly earnings increased by 4.1%.

The ability for sustained spending by the consumer, which accounts for approximately 68% of U.S. GDP, remains front‑of‑mind to most investors. Consumer credit expanded by $23.8 billion during November, as reported by the Federal Reserve earlier this week. This materially exceeded consensus expectations of $9.0 billion and October’s print of $5.8 billion.

The National Federation of Small Business released its Optimism Index for December. While the index increased 1.3 points (to 91.9), December marks the 24th consecutive month below the index’s 50-year average of 98. Inflation replaced labor quality as the primary concern of small business owners.

Earnings Season has Arrived

Companies have begun reporting 4th quarter 2023 earnings. Banks will be the focus this week as J.P. Morgan, Bank of America, Citigroup, Bank of New York Mellon and Wells Fargo will release their earnings reports on Friday. According to FactSet, approximately 75% of S&P 500 companies will report through month‑end. Stay tuned.

|

|

Sources: BTC Capital Management, FactSet, MarKit, Bureau of Labor Statistics, National Federation of Small Business

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.