American consumers continue to reflect their economic confidence and a willingness to spend, as evidenced by recent strong results from the automobile industry. Earlier this week it was announced that in the first half of 2023 auto sales increased approximately 13%. The most current estimate of light vehicle sales for the month of June indicates an annualized sales level of 15.7 million units. This compares to a level of 13.3 million units in June of last year. What makes this strength even more impressive is the fact that the average price paid for a new vehicle has reached approximately $46,000 and the average monthly payment is now $733.00.

While new car prices have continued to move higher, used car prices continue to decline. The Mannheim Used Vehicle Index fell 10.3% in June from its prior year reading, which represented the tenth consecutive month of annual declines. This reduction in used car prices has been a factor in lower inflation readings as evidenced by this week’s release of the latest Consumer Price Index report. The June annual increase of 3.0% was the lowest since March 2021.

Employment Data

Employment data was another significant theme in this week’s economic releases. Nonfarm payrolls grew less than expected with an increase of 209,000 while the JOLTS report of current job openings came in at 9.8 million. The unemployment rate ticked lower registering 3.6%. Labor statistics are showing some moderation but are still running at higher levels than the Federal Reserve (Fed) wants to see. This is a key contributor in the current 88.8% probability that the Fed will increase short term rates at the Federal Open Market Committee meeting later this month.

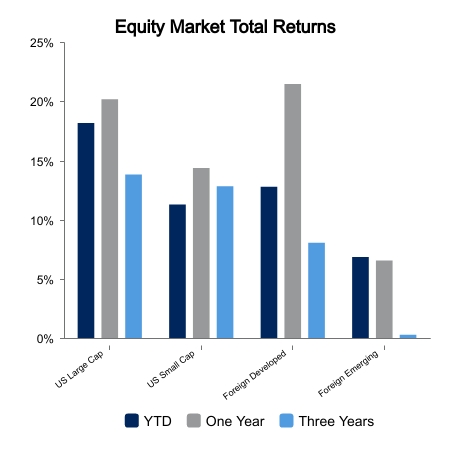

Equity Markets

Equity markets continued to move higher this week, buoyed by the continued moderation in the rate of inflation, with the Russell 3000 Index of domestic stocks advancing 0.7%. Small cap stocks were considerably stronger with a return of 2.0% for the period. The second quarter earnings reporting season commences this week with a consensus view that corporate earnings will show an aggregate year-over-year decline of 6.8%. Positive year-over-year results are forecast for the second half of the year.

International equities as measured by the MSCI EAFE Index did not fare as well as their domestic counterparts for the week having declined -1.3% for the period.

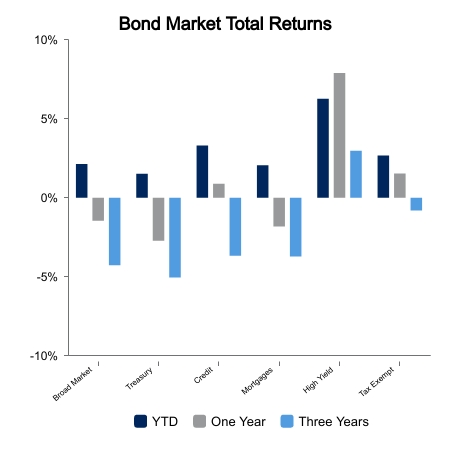

Fixed Income Market

Fixed income investors saw a positive return for the week as the broad bond market returned 0.6% for the week. Interest rates declined slightly with the 10-year U.S. Treasury issue registering a yield of 3.86% to end the week after starting at 3.93%.

|

|

Source: BTC Capital Management, FactSet, Refinitiv (an LSEG company).

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.