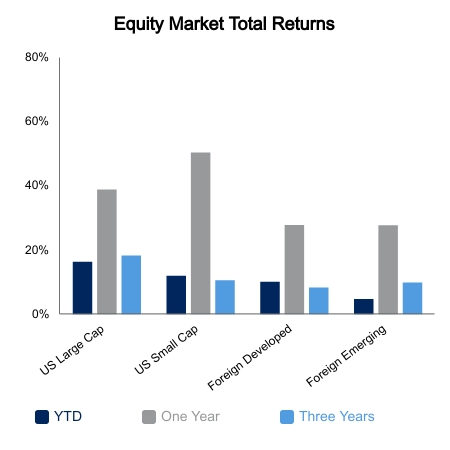

The S&P 500 inched up to again make a new all-time high led by tech mega-caps. Small caps were down 2.2% and continued their notable underperformance of late. Emerging markets remain down on the month but are not faring as bad as domestic small cap equities. Large cap domestic stocks continue their secular outperformance versus foreign developed and emerging market equities with year-to-date gaps widening.

Despite all-time highs in the S&P 500, divergences continue to mount. The Bloomberg Cumulative Advance-Decline line has failed to reach a new high, which is known as a bearish divergence. The Dow Jones Industrial Average and Russell 2000 have failed to take out their intraday highs. It has been four months since the Russell 2000 made a new high. The Dow Jones Industrial Transportation Index is down 9% from its intraday high in May and is sending a Dow Theory warning. On the surface, the above signals would be a warning sign, but market participants have bid up the implied volatility of longer-dated index put options, which widens the plausible downside scenarios seen by the market. We therefore see market participants positioning for downside, and it is often the case that bad news everyone knows about is not worth knowing at all.

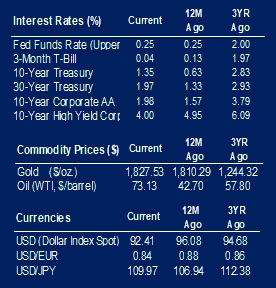

Core CPI came in at +4.5% versus the previous year, the highest level since 1991. This was followed by PPI, which also was hotter than expected, rising 7.3% on the year. Rhetoric from auto manufacturers, semiconductor companies and a plethora of businesses commenting in the Fed Beige Book is that inflation pressures will persist. What gives with inflation running hot and long-end yields moving lower? One argument is the Fed continues to suggest they will raise rates when necessary, and pricing across the curve suggests inflation will run hotter for longer, but then the Fed will hike faster to stem inflation concerns. The result will all but take a soft landing off the table and ensure a recession with sharply falling inflation expectations several years forward. The other argument is the fact that real wages were down 1.4% versus the prior year. They have been negative for three straight months whereas they reached as high as +7.4% in 2020. High debt levels and cost increases more than wage gains is not a recipe for booming growth in the coming years.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.