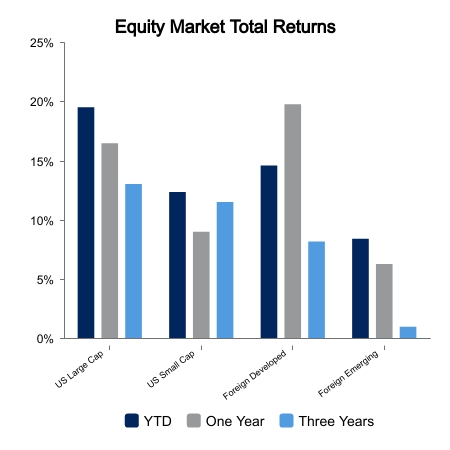

Equity Markets

Equity markets this past week continued to climb, up 1.9% for the MSCI USA Index which is a broad measure of domestic equity markets. In addition to the strong week the index is up 3.9% for the month and 19.2% for the year. Gains from financial sector stocks helped the advance this week as second quarter earnings for numerous sector members were better than expected. Weak sentiment for bank stocks remains despite stability in deposits, due to concerns about profitability, future regulatory pressure, and future credit losses. Overseas equity markets also advanced this week up 1.5%, and year-to-date 14.6% as reported by the MSCI EAFE Index. Markets in Japan were a key source of this gain after that nation’s central bank governor indicated a continuation of easy monetary policy.

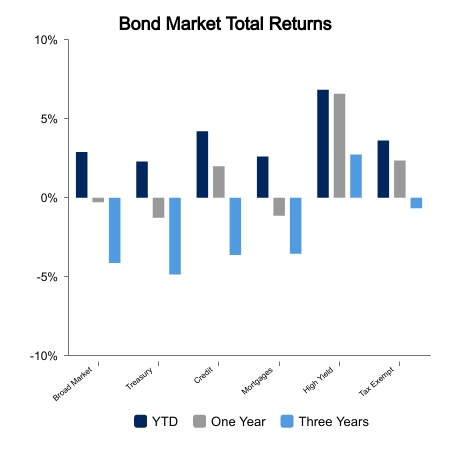

Bond Market

The modest 0.1% advance of the bond market this week lifted the year-to-date figure to 2.9%. A lower-than-expected Consumer Price Index measure last week increased the likelihood of a second half of 2023 soft landing for the economy improving the outlook for corporate credit. Corporate bond spreads tightened on this news despite facing the start of an earnings season that is likely to show slowing earnings due in part to a headwind caused by the rising cost of debt. Another short-term headwind for corporate credit is an increasing amount of new issuance led by financial firms following the release of earnings last week and earlier this week.

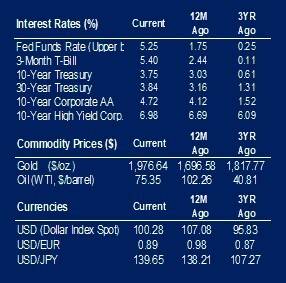

Fed Meeting Next Week

Softer-than-expected U.S. producer prices (PPI) bolstered our expectation of only one additional Fed rate hike this year. The PPI rose just 0.1% in June and on an annual basis, the slowest pace in nearly three years. Excluding food and energy, the core PPI rose 2.4% from this time last year. This last look at inflation ahead of next week’s Federal Open Market Committee meeting shows that the Fed’s intended goal of 2% inflation rate on the producer side is close to being achieved. However, core consumer inflation at more than twice this rate provides justification for a further rate increase next week.

Housing Market

A retrenchment in groundbreakings follows a surprise jump in the prior month’s figure as new home construction in June fell 8% to an annual pace of 1.43 million after a 15.7% jump in May. Applications to build, an indicator of future building, slipped 3.7% to an annual pace of 1.44 million. Despite the swings in figures, home starts are running at a pace above the pre-pandemic trend. High borrowing cost has not been a deterrent for new home builds as limited resale inventory and builder incentives have helped boost interest in new houses.

|

|

Source: BTC Capital Management, FactSet, Refinitiv (an LSEG company).

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.