Dow Jones Industrial Average Ties Longest Win Streak

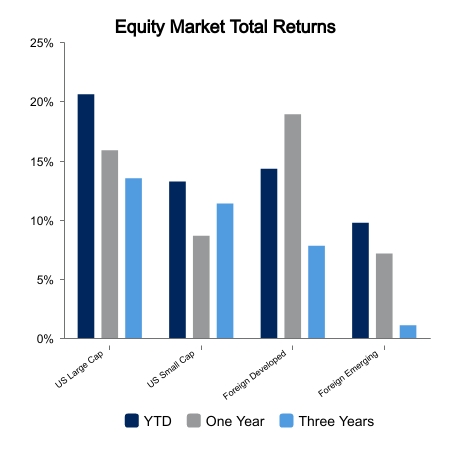

The S&P 500 finished the week unchanged amid a sector rotation. The NASDAQ was down 1.6% while the Dow Jones Industrial Average was up 1.3%. The story of the week was the Dow Jones Industrial Average notching its 13th consecutive positive day. This was the longest streak since 1987, and should it be up today, will set the record for longest winning streak in the 120+ year history of the Index.

Is stronger economic data really a good thing for the equity market?

The Leading Economic Index (LEI) was down for its 15th consecutive month. The big three detractors from the LEI over the last six months have been the inverted yield curve, weak consumer expectations, and falling ISM new orders. Is it possible these may have bottomed already? This could very well be the case based on data this week.

- The S&P Manufacturing Purchasing Managers’ Index for July jumped from 46.2 to 49.0. The widely followed ISM comes out next week.

- Consumer expectations, which goes into the LEI, just posted its second largest two-month change in last 10 years. It is at its highest level in 18 months.

- Trucking volumes for July are coming in better than the historical average following a protracted downtrend.

- The U.S. Dollar Index has been falling sharply in recent weeks, a condition which historically leads to an increase in manufacturing activity.

- The Chinese currency has strengthened a bit, which many consider a precondition to material Chinese stimulus.

The other key piece of economic data is jobless claims. The widely followed four-week moving average moved from 190,000 to 256,000 in June. This was more than 30%, which is historically the threshold for recession probabilities to spike. However, this series has now fallen back to 233,000. History suggests this data point needs to start spiking higher very soon or its signal of impending recession is negated.

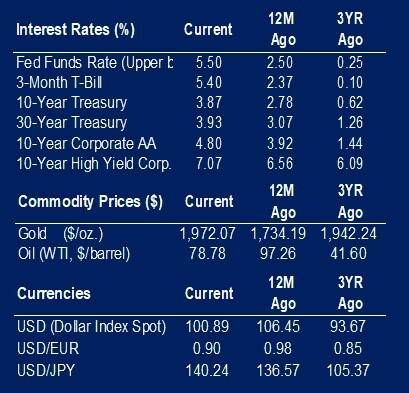

Is the Fed done hiking?

The Federal Reserve raised the Federal Funds Rate to 5.5% on Wednesday. It is deemed to be the last hike by many analysts. This may prove to be a false assumption given that business activity is picking up, the deficit has ballooned to 8%, the employment market remains tight, and commodities are moving higher on a falling dollar. Maybe the market is changing its mind quickly with the 10-year Treasury up 14 basis points so far today. Equities are putting a big gap-up, reversal-down day with the Dow Jones Industrial Average diving into the red and likely ending the streak.

|

|

Source: BTC Capital Management, FactSet, Refinitiv (an LSEG company).

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.