Some new housing data was released this week. Existing home sales came in higher than expected but lower than the previous month. We have seen month-over-month dips since the beginning of the year. In May, 5.8 million homes were sold versus the expected 5.7 million and the previous month’s 5.85 million.

New home sales for May were lower than the expected 875,000 at 769,000. The lower-than-expected number comes as many builders pause or cancel projects due to material cost pressures. Building is expected to pick up once the cost of supplies comes down. There have been significant drops in the price of lumber as more lumber mills ramp up production.

The median price of an existing home in May was $350,300 and $374,000 for a new home. The large price increases are forcing out new home buyers. We may see some moderation in home prices in the next few months.

The final report for building permits in May recorded no changes from the initial report. The number of permits issued stayed at 1.681 million.

Preliminary Markit Purchasing Managers’ Index numbers for June are out. Manufacturing is at a healthy 62.6. Estimates had the number at closer to 61.5. The actual number shows purchasing managers expect growth in manufacturing. The services numbers was also strong at 64.8 but lower than the expected 69.8 and the previous month’s 70.4. The composite number for the month was at 63.9.

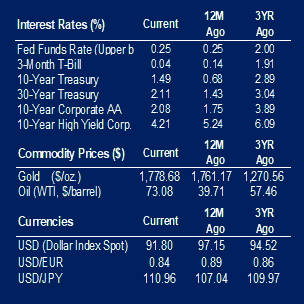

The U.S. rig count continues to increase as the demand for oil rises. This week, the total rig count was at 470. There have been consistent increases since the August 2020 low of 244. Oil prices as measured by WTI Crude have been around $70/barrel for most of June.

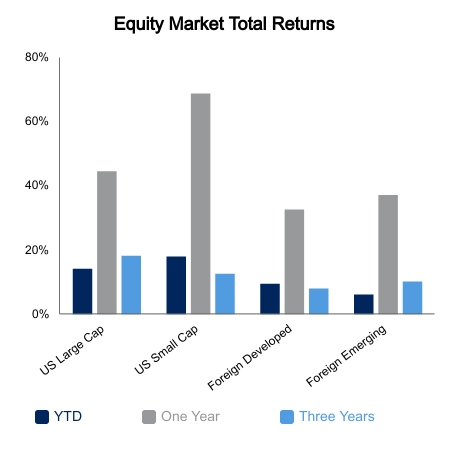

U.S. equity markets are up this week by 0.44% as measured by the S&P 500. Performance was led by strong moves of 2.35% and 2.09% by the Consumer Discretionary and Information Technology sectors. Detractors from performance were financials, utilities and materials.

The Index of Leading Indicators was up by 1.3%. The index is a composite of 10 leading indicators. The reading is in-line with last month’s number of 1.3% and slightly higher than the expected 1.2%.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.