Did Equities Already Price in the Recession?

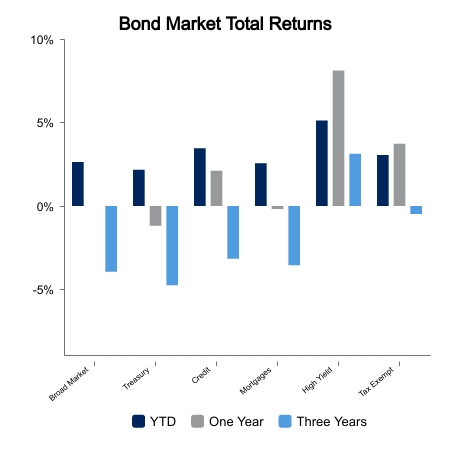

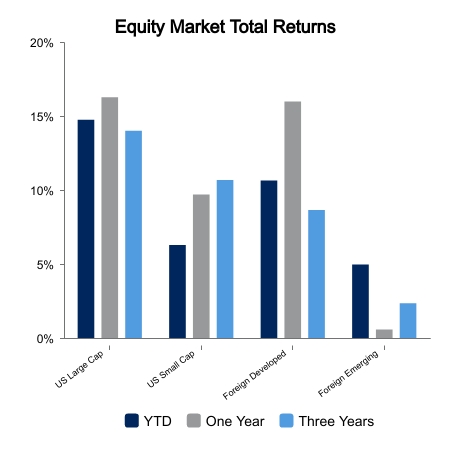

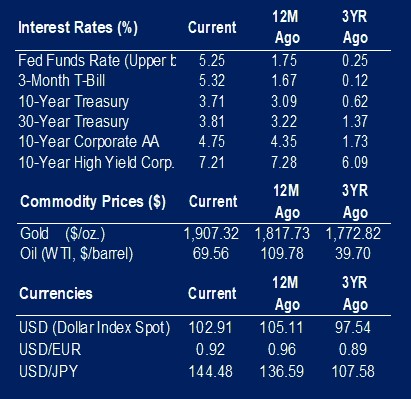

Markets took a pause this week to digest recent gains. The S&P 500 was up 0.3% as modest gains in the NASDAQ were offset by modest gains in small cap equities. Foreign equities were a little softer with both developed and emerging markets down a little over 1%. Core bond returns were flat as implied interest rate volatility finally returned to levels seen prior to the Silicon Valley Bank collapse.

Digging into the Leading Economic Indicators

The Leading Economic Index (LEI) was down 0.7% versus the prior month. It was the fourteenth consecutive monthly decline. The aggregate index is 9.4% off its high and drops of this magnitude are always associated with recession. Therefore, many conclude equities are a dangerous place to be. They may be forgetting that equities are the king of leading indicators.

LEI drops 10-12%

- In August of 2001, the LEI was down about 9%. The S&P 500 had a drawdown of 20-25%. Then September 11 happened, which was a shock to a fragile economy.

- In December of 1988 the LEI peaked only to see the S&P 500 race 40% higher. There would be a 20% pullback in 1990 as the series troughed, but equities were never below their 1988 level.

- In 1978 the LEI would drop 13% in the first of the double-dip recessions. Despite this, the S&P 500 was up 30%, which included a six-week 20% drawdown in March 1980.

- The 1982 recession, the second in short order, saw the LEI down 9% at its low point. The S&P 500 drawdown was about 20%. It would surge 66% over the following year.

- If you combine 1978-1982, the LEI fell 17% in aggregate, yet the S&P 500 was up 58%. This is likely due to real returns of -50% over an eight-year period and extreme negative sentiment. Neither of these are in play today.

LEI drops more than 15%

- The recession of 1974 saw the S&P 500 drop 25% by the time the LEI was down 9%. The total drawdown was about 40%.

- In March 2008, the LEI was down 9% from its peak. The S&P 500 was up about 6% from when the series peaked in 2006 but was down about 18% from its high.

- While the market didn’t foresee the financial crisis in 2008 until later, by the time the LEI was down 9% in both 1974 and 2008, the S&P 500 was near a 52-week low.

This cycle the S&P 500 had a drawdown of 20-25% but is now 25% above its 52-week low. Despite the media saying that no recession is priced in, the market likely already priced in a recession with the drawdown in 2022. Equities and the LEI are more aligned than one would initially think. It is certainly reasonable that some or maybe all the 25% rally is prone to pullback as the recession becomes clear. But unless the LEI falls 15% or more, i.e major recession, the market bottom set in 2022 has a good chance of holding.

|

|

Source: BTC Capital Management, FactSet, Refinitiv (an LSEG company).

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.