Sector Dispersion Solved as Small Caps Surge

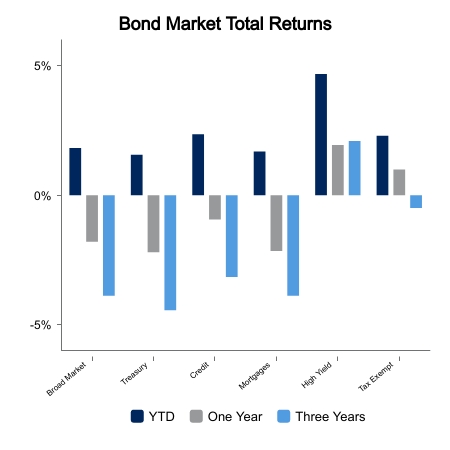

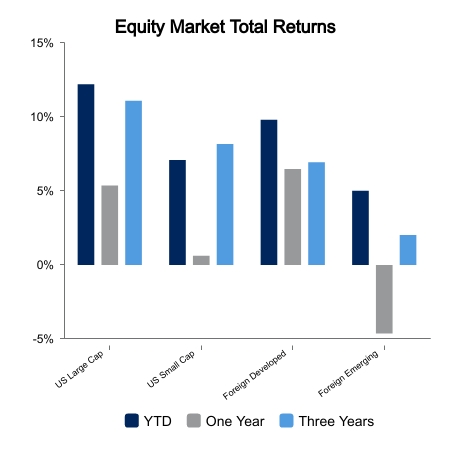

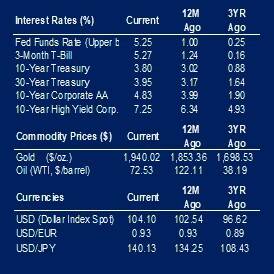

The S&P 500 tacked on another 2.1% this week as small caps staged a vicious rally following the Friday jobs numbers. Small caps were up 8.0% this week and notched their largest five-day advance in more than two years. Weakness in small caps had been a common talking point as a reason to be skeptical of the rally but is no longer true. Core fixed income was down 0.7% as yields moved higher.

Getting Real with the Data

Economic data was generally weaker this week with the ISM manufacturing data coming in at 47.0. Prices paid dropped significantly and the all-important new orders was at a weak 42.6 and at the lowest level this cycle. ISM Services came in way below expectations with a reading of 50.3 versus expectations of 52.4. Despite this, the only data point that seems to matter now is the employment report, and really, only part of that report.

The Bureau of Labor Statistics reported that nonfarm payrolls increased by 339,000 in May, which blew away consensus expectations. The streak is now 14 consecutive months with the actual number coming in better than expected. The other half of the report, the Household Survey, showed a decline of 310,000 jobs. As a result, the unemployment rate jumped from 3.4% to 3.7%. The market ignored the weak half of the report and ran with the big headline number. Cyclical stocks had a fantastic week and bond yields moved higher.

The prospect of no recession is becoming consensus, but these are the factors that the National Bureau of Economic Research uses in defining a recession. The bold items are where they have leaned more heavily in recent decades.

- Real personal income less transfers

- Nonfarm employment

- Household employment

- Real personal consumption expenditures

- Real Wholesale and Retail sales

- Industrial production

Industrial production is flat versus the prior year, which is associated with recession starts. Real retail sales are down more than 5% over the past year while wholesale trade is off 10%. These numbers are at recession levels already. Real personal consumption expenditures are around 2.5%, and while well off the highs, are holding above zero. Employment remains strong, but real personal income less transfers is weak. This series is up just 1.2% from the pervious year and should be running between 2.5-5.0% during normal economic times.

With high inflation it is important to note that real data and real returns are what matter. The S&P 500 real earnings are down 15% from a year ago. The S&P 500, despite being 19% off its lows, is still more than 16% below its inflation adjusted monthly peak.

|

|

Source: BTC Capital Management, FactSet, Refinitiv (an LSEG company).

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.