The big number being talked about this week is the unemployment rate. The reading of 5.8% is down from last month’s 6.1% and the number of unemployed people is at 9.3 million. The report is better than the expected rate of 5.9%. Nonfarm payrolls rose by 559,000. Leading the gains were increases in leisure and hospitality, and in public and private education. Twenty-five states are ending their participation in federal unemployment programs early. It will be interesting to see the impact of that decision on employment. There is an econ PhD candidate out there fortunate that they finally have a control group for their employment experiment.

Labor force participation was flat at 61.6%. This number has stayed in a narrow range of 61.4 – 61.7% since the middle of last year. This range is almost 2% lower than February 2020’s rate of 63.3%.

Hourly earnings were up 0.5% in May, which was higher than the expected 0.2%. Hiring difficulties have contributed to this larger-than-expected increase. The increase contributes to rising fears of continued inflation.

Consumer credit grew by 5.3% year-over-year in April. Non-revolving credit led the growth with an increase of 7.6%. We have seen increases in non-revolving credit every month this year. Revolving credit dipped in the month by 2.4%. The increase in consumer credit brings total outstanding borrowing up to $18.6 billion.

Durable goods orders were down by 1.3% in May. The decrease comes after 11 months of increases. The leading detractor was orders of transportation equipment, down 6.7%. Excluding transportation, orders were up 1%.

Final readings for the Purchasing Managers’ Index Composite number came out this week. The strong reading of 70.4% indicates purchasing managers are optimistic on the economy.

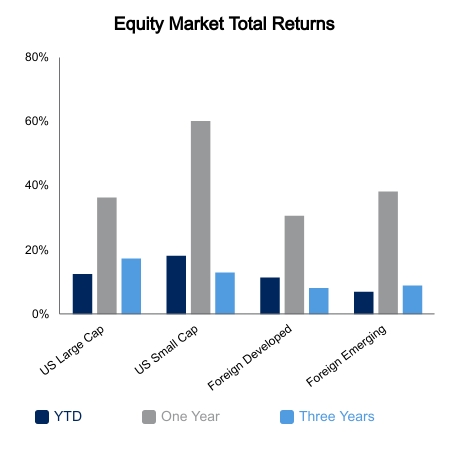

Performance across equity market sectors was mixed this week. The best performing sector for the S&P 500 was the healthcare sector, up 1.72%, led by biotech companies. The real estate sector was another strong performer, led by performance in office real estate investment trusts. Materials, a sector up close to 50% this year, was a laggard for the week, down 1.63%.

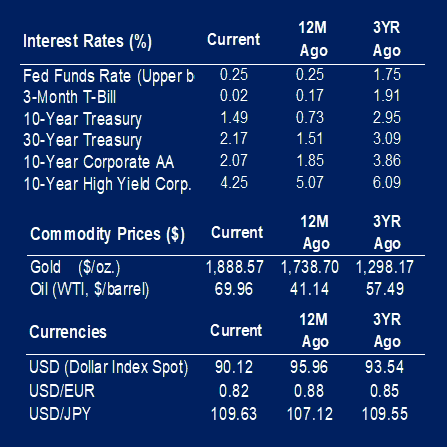

Pricing for WTI Crude, a proxy for oil, was up close to 1% this week. Pricing is expected to increase as demand for the commodity increases over the next few months.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.