Equities are Moving Like a Tremendous Machine

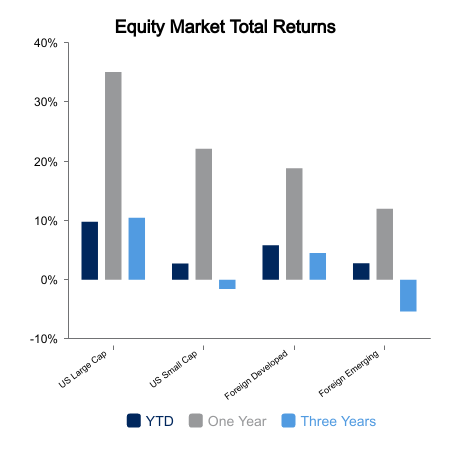

Equities are starting to look like Secretariat at the Belmont Stakes. All major indices closed higher on the week and at all-time highs. They are currently in their ninth consecutive week with a Relative Strength Index (RSI) reading above 70. This is often cited as the key level for being overbought. For the first time since 1971, the S&P 500 has gone 20 consecutive weeks above its eight-week exponential moving average. Wednesday saw the highest ratio of advancing issues to declining issues on the New York Stock Exchange (NYSE) this year.

Breadth has expanded far beyond a few select semiconductor stocks. Companies that benefit from building the datacenters and infrastructure are seeing their stocks go vertical. A boring industrial like Eaton, has seen its stock go up 340% over the last four years. It is by far the biggest 48-month increase in share prices since they went public more than 50 years ago. Comfort Systems USA is up 782% in four years. Builders FirstSource, a supplier of structural building products, is up 1,600% in four years and has outpaced NVIDIA.

Central Bank Reaction Functions are Now a Tailwind to Equities

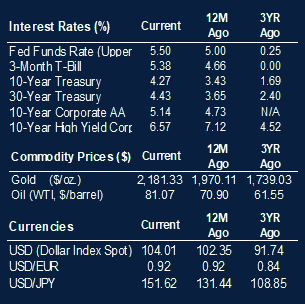

It was a heavy week on the central bank front. The Bank of Japan made history by raising interest rates for the first time in 17 years and abandoning negative interest policy. Despite the hike, the yen is on the cusp of breaking to a 35-year low versus the United States dollar. The Swiss National Bank surprised with a rate cut today, marking the first major central bank to cut rates.

The Federal Open Market Committee (FOMC) met and kept the Federal Funds rate unchanged at 5.5%. This was 100% baked into the market, but all eyes were on the reaction function to recently elevated inflation readings. A hawkish tone could cripple the prospects for rate cuts and leave markets vulnerable to a sizeable correction. A dovish tone and the markets would likely get the message that they no longer need to fear the Fed.

While Fed Chairman Powell said more data was needed for a cut, the market clearly jumped on the dovish undertones. Higher inflation readings were deemed to be a “bumpy” process toward lower long-run inflation. Higher unemployment and slowing growth are no longer precursors to cutting rates. The FOMC significantly upgraded their growth forecasts for the year. They also upgraded their inflation forecasts for 2024 and 2025. These inputs would normally yield a rate hiking reaction function, but the FOMC continued to forecast three cuts this year. The equity market rally resumed immediately.

|

|

Sources: BTC Capital Management, Bloomberg

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.