Waiting for Directions

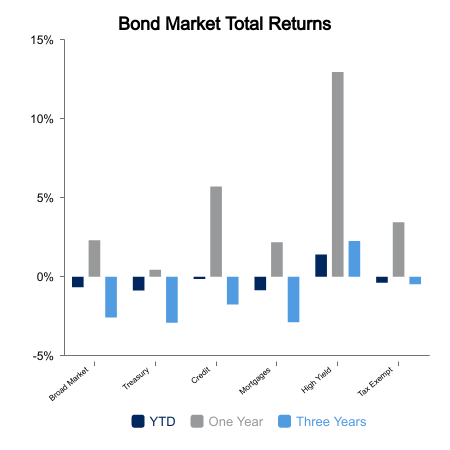

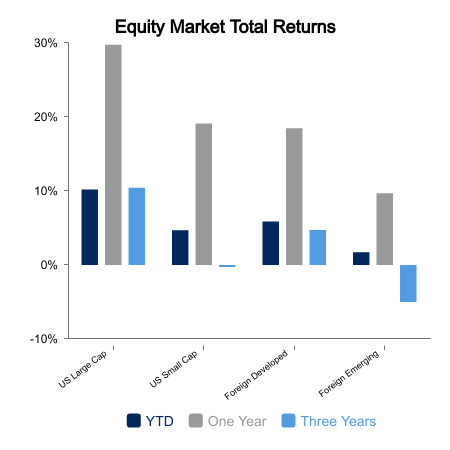

Stocks wavered but continued to advance this week as traders assessed the outlook for corporate earnings ahead of a new reporting cycle. Equity market momentum slowed this week as the S&P 500 Index gained just 0.2% compared to month-to-date and year-to-date advances of 2.9% and 9.7% respectively. The S&P 500’s advance still set a record high for the index that has not seen more than a 5% pullback since October 2024 when interest rates peaked. The MSCI ACWI ex USA Index reported a -0.4% pullback of overseas stocks as the United States dollar climbed, resulting in a decline in value for United States holders. Foreign stocks continue to trail domestic stocks reporting a year-to-date return of 4.0%. Bond markets advanced 0.6% this week as measured by the ICE BofA US Corporate, Government and Mortgage Index as interest rates declined slightly. A return year-to-date at -1.6% reflects the shift in the markets view that a slower pace of interest rate declines will delay bond price advances.

United States manufacturing expanded in February by the most since mid-2022 as production and factory employment growth accelerated according to the latest S&P Global Composite PMI report. This measure contrasted with the decline recorded earlier in the month by the ISM Manufacturing PMI of 47.8 versus 49.1 prior. The Conference Board Leading Economic Index (LEI) for the United States rose 0.1%, the first increase in over a year. These advances may be hard to repeat in the coming months as supply chain issues are back in focus following a massive cargo ship colliding with the 1.6-mile Francis Scott Key Bridge in Baltimore. As the ninth largest United States port by trade volume, it handles the nation’s largest volume of automobiles and goods such as sugar, coal, gypsum and lumber with total trade amounting to $80.8 billion.

Sales of new homes in the United States edged higher in January as builders and buyers benefited from lower mortgage rates at the start of the year. New single-family home purchases increased 1.5% to a 661,000 annual pace. The median sales price of a home decreased to $420,700 in January marking the fifth-straight decline, as the supply of new homes increased at the fastest rate in over a year, as reported by the Census Bureau and the United States Department of Housing and Urban Development.

Finally, a $1.2 trillion funding package was signed that keeps the United States government running through September 30, averting a partial shutdown but also assures pre-election fireworks this fall.

|

|

Sources: BTC Capital Management, ICE BofAML, MSCI, Institute for Supply Management, Bureau of Labor Statistics, Standard & Poors, S&P Global and National Association of Realtors

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.