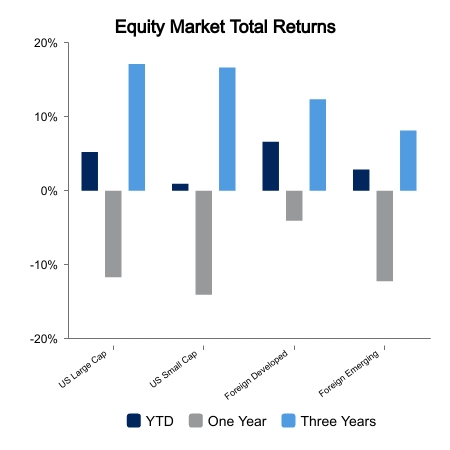

Equities Grind Higher

Broad equity market indexes all advanced over the past week as fears pertaining to recent bank failures abated while investors cling to the mantra of a soft-landing. The Russell 3000 rose 2.1% as Value outperformed Growth (+3.1% versus +1.2%). Foreign equities also advanced, albeit muted compared to domestic indexes, as the MSCI All‑Country World Index ex-USA rose 0.6%.

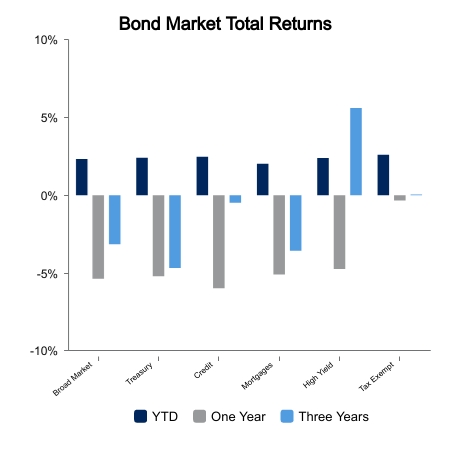

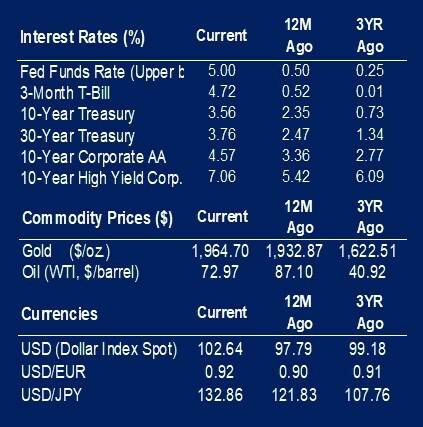

Interest Rates

Over the last week, the yield on the U.S. Treasury 10-Year Note rose to 3.6% from 3.4% given the perceived stabilization within the banking sector, thus the anticipation of an active Fed.

Consumers Remain Resilient

This morning the third and final estimate of U.S. Gross Domestic Product (GDP) for the fourth quarter 2022 was released. GDP rose 2.6% quarter‑over‑quarter, modestly below the 2.7% increase of the prior estimate. One key downward revision was in consumer spending to +1.0%, down from the prior estimate of +1.4% and below the +2.3% reported for the third quarter 2022. Consumer spending has been a key driver sustaining the economy. Recall that retail sales rose in January 3.0%, a large surprise to the upside, and overall retail sales are anticipated to increase during the first quarter 2023.

This week The Conference Board released the results of its Consumer Confidence survey for March. This survey acknowledges consumer attitudes, and consumer expectations for inflation, stock prices, and interest rates all believed to impact business conditions in the months ahead. This survey exhibited a slight increase to 104.2 during March, which was modestly above February’s reading of 103.4. Its Expectations Index, which reflects consumers’ short-term outlook for income, business, and labor market conditions, also increased to 73.0 from 70.4 in February. The Conference Board noted that “for 12 of the last 13 months—since February 2022—the Expectations Index has been below 80, the level which often signals a recession within the next year. The cutoff date for the survey was March 20, about 10 days after the bank failures in the United States.”

Initial unemployment claims continue to support a scenario of a sustained and strong employment situation. Claims for the week ending March 25, 2023, came in at 198,000, modestly above consensus expectations of 196,000. Year‑to‑date weekly claims have been below 200,000 except for the weeks ending on January 7, 2023 (206,000), and March 4, 2023 (212,000). Note that claims prior to the recessions of 2001 and the Great Financial Crisis (2008 ‑ 2009) hovered above 350,000 and did not trend to current levels until after 2014.

|

|

Source: BTC Capital Management, Bloomberg LP, FactSet, Refinitiv (an LSEG company).

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.