Sharp Reversal Sends Risk Assets Lower

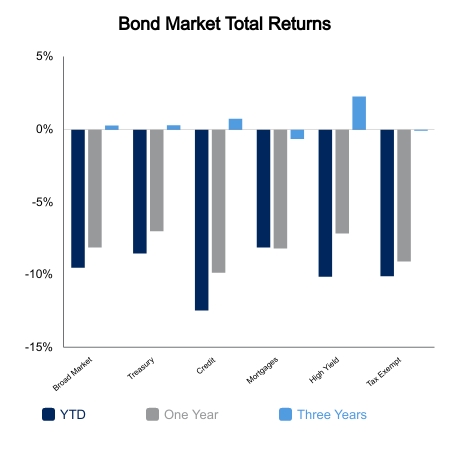

The massive rally post-Federal Open Market Committee meeting last Wednesday turned out to be a head fake. This week saw significant losses in risk assets. The S&P 500 was down 8.5% on the week with losses more extreme in higher valuation and cyclical companies. The Russell 2000 was down 11.9% on the week and the NASDAQ fell 12.3%. Initially the sell-off was driven by higher interest rates but selling continued even as rates made a sharp reversal lower in recent days. For the year, the S&P 500 is down 17%, the NASDAQ down 27% and broader fixed income down 9.5%. It is now the worst start to a year in the S&P 500 in at least 60 years. And it’s the worst start ever in the history of the NASDAQ dating back to 1970. As for fixed income, we have already highlighted the historic drawdown.

Bonds Reverse

- 10-year Treasury yield hits 3.20% this week, then touched 2.80% three days later

- Inflation remained stubbornly high

- Commodities and fixed income appear to be incorporating lower growth forecasts

- Credit spreads remain contained

Process and Patience

The market continues to punish the high multiple and money losing stocks. Nearly every high-flyer in the market rally of 2020 has witnessed declines of 70-90% from their highs. This week also saw some significant stress in the cryptocurrency markets. Some unprecedented things are happening to cause significant investor losses in this space. Wildly popular growth funds are witnessing 6-10% losses for a fund in a single day and are down 60-80% from their highs. Investors and advisors that felt pressured to chase the hot thing have witnessed extreme losses.

On the contrary, The S&P 500 low volatility index hit an all-time high in April. It has pulled back in recent days but has continued to make higher highs and higher lows over the last two years. The boring Berkshire Hathaway has now overtaken the NASDAQ in performance since the pandemic low. The speculative and popular ARKK Innovation Fund raced to a more than 250% advantage versus Berkshire Hathaway in the first 11 months of the 2020 bull market. Now Berkshire is ahead by 93% and this is all in just over two years.

While drawdowns are never a pleasant thing, it is worth noting that we avoided many of the potential pitfalls by sticking to a consistent process. Those that felt like they “missed out” remain in a position to continue to grow wealth over time. For instance, The S&P 500 low volatility index only needs to gain 8.6% to recoup its losses whereas the ARKK Innovation Fund needs more than a 300% gain.

|

|

Source: BTC Capital Management, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.