The Fed Hikes Rates by 50 Basis Points for the First Time Since 2000

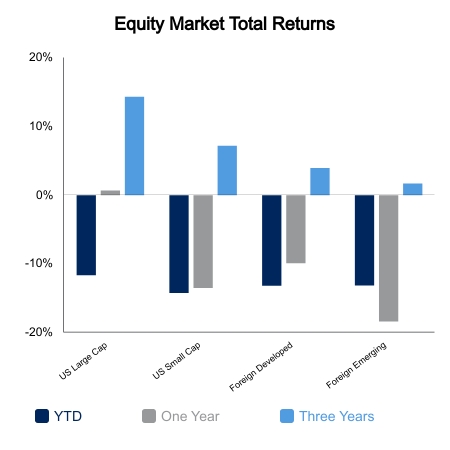

The S&P 500 ended the week up 2.8%, with all the gains coming in the last two hours on Wednesday. Stocks surged mid-way through the Federal Open Market Committee (FOMC) press conference after Chair Powell indicated that 75 basis point increases are not on the table in the foreseeable future. The NASDAQ would rally almost 4.5% from the low in the final hour and half of trading. Prior to the rally, the equity drawdown was extended this week. The S&P 500 closed 13% below its high on Monday while the NASDAQ drawdown exceeded 23%.

The Fed Gives Clarity

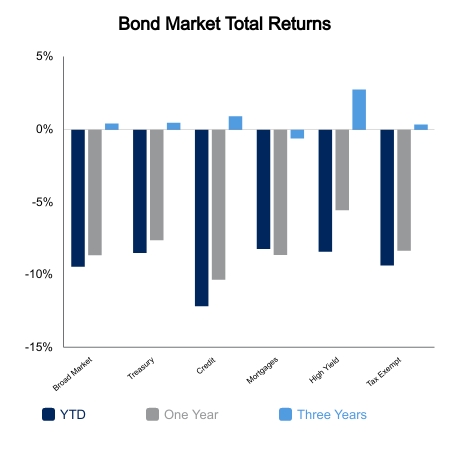

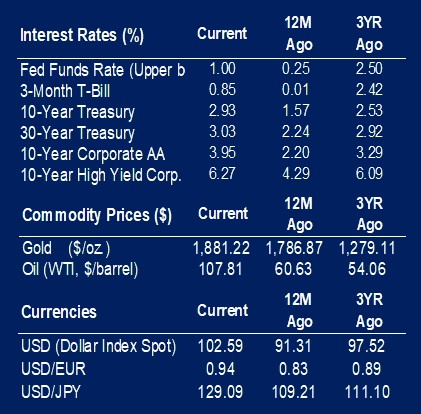

The highlight of the week was the FOMC meeting where the Fed was expected to raise interest rates by 50 basis points for the first time since 2000. Leaving the question, what would forward guidance be? The Fed did indeed increase their benchmark rate by 50 basis points but took the prospect of a 75-point increase in the coming meetings off the table. They suggested multiple 50-point hikes will be plausible depending on how the economy evolves. The market rejoiced. Bond yields moved lower as the odds of a 75-basis point increase were taken lower, although remain greater than zero.

Quantitative tightening will begin on June 1 with the Fed balance sheet falling by $47.5 billion per month. This level can rise to $95 billion after three months. These numbers were in line with market expectations.

The U.S. Dollar hits 5-year High

- The United States implied terminal fed funds rate is 3.5%.

- Japan continues to buy unlimited 10-year government bonds at 0.25%.

- The European Central Bank deposit rate remains at -0.50%.

- The Bank of England notes heightened recession risk which lowered their yields and currency.

Moderating Growth

The economic data came in below expectations for the most part. First quarter GDP fell by 1.4%. The ISM Manufacturing Index reading for April was 55.4, but well below expectations of 57.6. New orders hit a recovery low reading of 53.5. ISM Services was better at 57.1, but again missed expectations. The ADP employment report showed private job gains of 247,000 versus expectations of 383,000. Small business jobs contracted in April. Challenger job cuts have been sneaking higher, although remain low. Job growth may be facing some headwinds from the technology sector where several prominent companies have announced job cuts or at least reduced need for labor.

|

|

Source: BTC Capital Management, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.