Equities Rally as Event Risk Fades

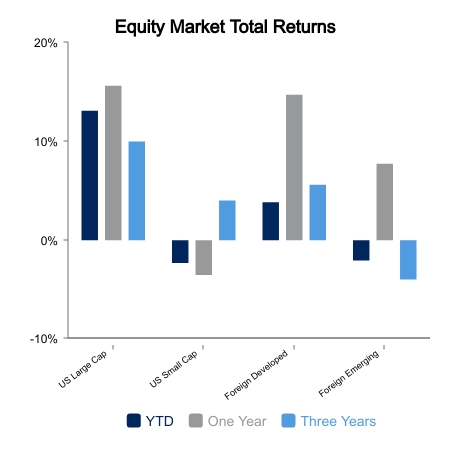

Equities came into the week in a notable correction. The S&P 500 was 10% below its July peak and small caps down almost 20%. Big events for the week included the Bank of Japan and their future path of policy, the Federal Reserve meeting, and the Treasury Quarterly Refunding announcement. As is usually the case, participants hedge ahead of the events. This paves the way for a potential rally absent a shock scenario.

The Bank of Japan continues to move toward removing extreme monetary support but continues to do so in a very slow manner. The Treasury announcement was never widely followed, but bond yields surged after they upsized issuance needs in July due to a ballooning deficit. Now, this was more important than the Fed meeting later in the afternoon. Everyone was in fear of another large issuance, but this failed to materialize. More importantly, the Treasury upsized the allocation to short-term Treasury bills versus their historical relationship. The fear was that a lot of long bond issuance would pressure yields and weigh on risk sentiment. The move to bills was a green light to market participants. Equities immediately rallied 1% after the Treasury announcement. But they couldn’t run too far with the Fed on deck in the afternoon.

The Federal Reserve left the Federal Funds Rate unchanged at 5.5%. The consensus view was that Jerome Powell was dovish as he noted that risks have become more symmetrical. They still maintain a hiking bias but see risks as balanced and current policy rates as sufficiently restrictive. The market is pricing in the current Fed Funds Rate as the peak rate. With Fed risk removed, the market was free to run in its knee-jerk direction following the Treasury release. Including today, the S&P 500 is up another 2.5% in less than 24 hours from Powell’s comments.

- The S&P 500 was up 1.2% on the week.

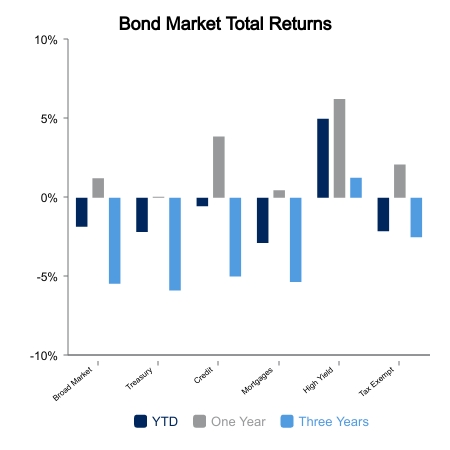

- Core bonds were up 1.3% on the week.

- 10-year Treasury yields are 30 basis points below their October high.

Technology normally does well when rates fall, but there has been some iffy performance around earnings. A broad-based rally would need some value participation and likely rotation into some underperforming sectors. The value play that benefits from falling rates is Real Estate Investment Trusts (REITs). They were up 3.3% last week and are surging another 3.5% today.

The last little potential hiccup for markets is the labor report tomorrow. Consensus is around 180,000 job gains and absent a material deviation, equities appear to have the sufficient catalyst for a year-end rally.

|

|

Source: BTC Capital Management

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.