Equities Surge Following CPI Report

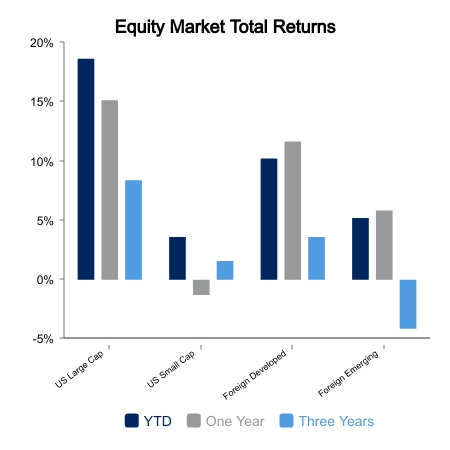

Equities paused last week to consolidate large gains following the Federal Open Market Committee (FOMC) and Treasury funding announcement. Fears were elevated that the Consumer Price Index (CPI) would miss to the high side. Instead, it was a little better than expected and equities staged another huge run. The S&P 500 gained 2.8% on the week with the NASDAQ faring better at 3.4%.

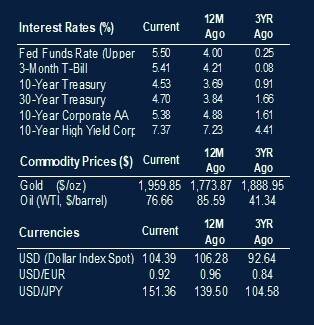

The S&P 500 staged its largest 10-day rally since 2022 with a gain of more than 7%. The 10-year Treasury is now more than 50 basis points off its high as the market has repriced in two more rate cuts by July of next year. This caused financial conditions to fall notably. This is widely followed as a measure of monetary tightness. It incorporates government bond yields, currency, equity valuations and credit spreads. Despite the Fed raising interest rates to 5.5%, financial conditions are at the same level as when the Fed Funds were 2.5%.

Will the Fed cut with financial conditions easing?

Household financial assets as a percentage of GDP are about 50% higher than in the 1970s. This implies the wealth effect is more important than ever. It supports the theory that the equity markets need to fall to trigger a recession instead of a recession causing the equity markets to fall. This theory is based on the notion that corporations will hoard labor if their stock price is performing satisfactorily but will be forced to act should it fall significantly. We saw this in the technology space in 2022 with pet projects cut due to the precipitous fall in the company’s stock price. This was a big factor in technology’s strong performance this year. Financial conditions this cycle peaked at a lower level than the 2016 soft patch that was never a recession.

Core CPI was up 0.2% versus the prior month. CPI excluding shelter has now been under 2% year-over-year for five straight months. This is used because shelter is still running +6.7% in the CPI report despite real time data showing it roughly flat. In the July FOMC press conference, Fed Chair Powell said if inflation was coming down sustainably, then they don’t need to be at a restrictive level anymore. He specifically noted that they would want to start cutting before reaching 2% inflation.

Given these remarks, it makes sense for the bond market to price in cuts on falling inflation. This would be supportive for not only equity markets, but housing and other interest rate sensitive areas of the economy. Rising financial assets feeds back into the economy and consumer confidence, thereby reducing the likelihood of a recession.

|

|

Source: BTC Capital Management, U.S. Bureau of Labor Statistics

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.