Stocks Surge on Lower Inflation

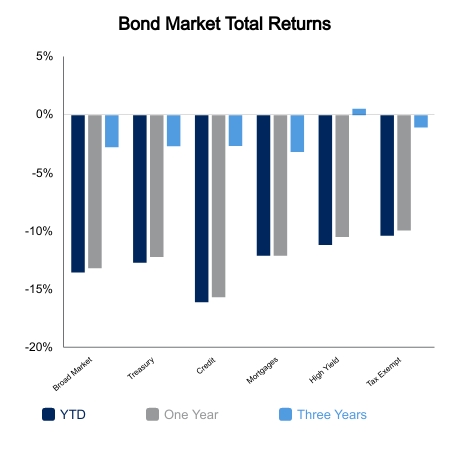

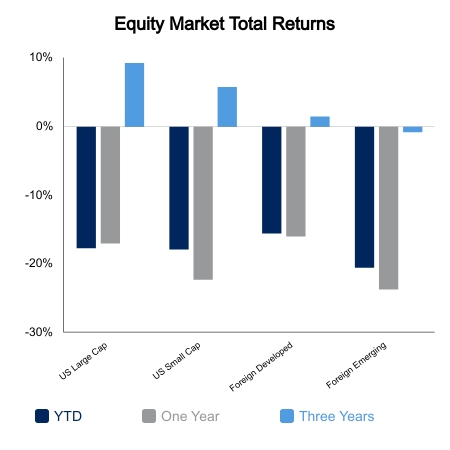

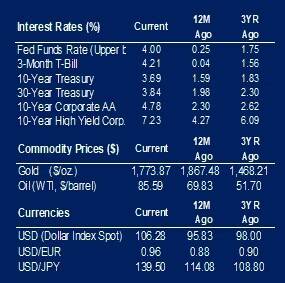

Equities surged last Thursday when the Consumer Price Index (CPI) came in lower than expected. The S&P 500 jumped 5.55% on the day, the largest single-day gain since March 2020. The NASDAQ’s 7.4% gain was the 14th largest in the 50-year series history. The 13 larger daily moves all occurred during recessions and only one (March 24, 2020) did not result in new lows before the bear market was over. Yields plunged lower on the week with core bonds returning more than 3%. It was the largest five-day gain for core fixed income since 1988.

Inflation Heading Lower

The lower CPI reading sparked an enormous equity rally, most notably in beaten up technology names that had seen their share prices drop 90% or more from the peak. Some of the formerly loved growth stocks were up 40-60% in 3 days. Producer prices would confirm the consumer price drop with a flat reading versus the prior month. This reading is for final demand, but intermediate stages have declining prices which normally make their way into the final reading with a lag. Raw industrial prices were down 20% over a six-month period through October. Going back to 1980, this index only saw a larger six-month drop during the 2008 financial crisis.

The initial reading on the Atlanta Fed GDP Now for the current quarter is 4.4%, but data for the week was mostly disappointing.

- Retail sales came in much better than expected, but changing holiday shopping and shifting Amazon Prime days make comparisons difficult.

- Walmart beat earnings and its stock popped, but Target fell well short.

- The National Association of Home Builders Market Index continues to fall sharply.

- The Empire Manufacturing six-month forward new order outlook dropped to a lower level than anytime in series history (2001).

Crosscurrents Make for Murky Environment

China made subtle hints that the reopening process is underway. This fueled a huge rally in Chinese-related equities and likely some spillover into the U.S. market as well. Pessimism has quickly flipped following the CPI as the consensus is now looking for an equity rally at least until year-end. Cryptocurrencies took the spotlight this week with major fraud and a wave of bankruptcies. Bitcoin is now down 76% in just over a year. It’s too early to know the ultimate spillover but it may be an underappreciated risk.

|

|

Source: BTC Capital Management, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.