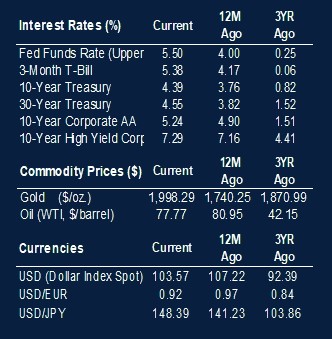

Bond markets continued to post positive returns this week, as measured by the ICE Domestic Master Index. Month-to-date bond market returns reached 3.6%, pulling year-to-date returns further into positive territory at 0.8%. Declining rates have boosted prices of long maturity bonds, while corporate bonds gained as investor concerns of credit risk lessened. Corporate bond spreads reached a 12-month low, helped by solid third quarter earnings and a wider breadth of sector participation in equity market advances.

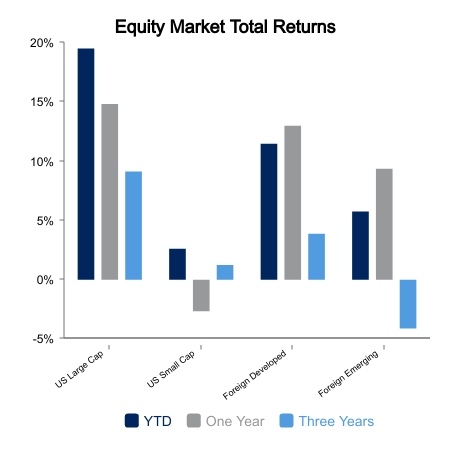

The MSCI USA IMI Index, a measure of the broad equity markets, advanced 0.7% this week pushing this month’s gain to 8.4% and 18.8% for the year. This past week both Health Care and Technology advanced over 1.2%, while Energy stocks declined -1.3% as lower oil prices (down 8.8% for the month) shaped investor outlook for lower top line revenues.

Released this week was the American Farm Bureau Federation’s 38th annual survey of the average cost of a Thanksgiving meal for 10, which is down 4.5% from last year to $61.17. While this is good news, it also reported that this is up 25% from 2019. By comparison home prices are up 45% since 2019 and with 30-year mortgages at 7.7% the National Association of Realtors Housing Affordability Index shows the lowest home affordability level since figures started in 1986. This was reflected in this week’s release of new home starts up 1.9% while in contrast existing home sales were down -4.1% in October and -14.6% over the last year. With existing homeowners unwilling to move out of a home with a low-rate mortgage, many home buyers with limited choices are opting to build new. This demand has lifted the S&P 500 Index homebuilder sector to an advance of 48% for the year, at a time when mortgage costs should have been a major drag on this sector.

This month’s release from the Federal Reserve of U.S. Industrial Production showed factory output decrease 0.7%, the most in four months, weighed down by a 10% drop in motor vehicle production due to strikes. Recent factory surveys have indicated tepid new orders across sectors, which also showed increasing concerns as factories continue to face slowing economic activity overseas, high borrowing costs and an uncertain outlook. The Federal Open Market Committee’s (FOMC) meeting minutes released this week revealed financial conditions are clearly on the Board’s mind as the report noted downside risk to the economy of more rapid labor market cooling and signs of slower credit demand. These concerns were balanced by the FOMC’s view that labor market conditions are tight and consumer spending remains strong.

|

|

Source: BTC Capital Management, ICE Domestic Master Index, MSCI USA IMI Index, American Farm Bureau Federation, National Association of Realtors Housing Affordability Index, Federal Reserve of U.S. Industrial Production

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.