We issue this week’s Insight somewhat early, given the Thanksgiving holiday, allowing all to hopefully relax and recall those things for which we’re thankful.

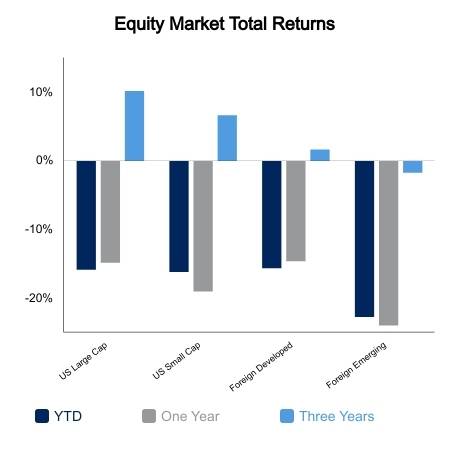

U.S. equities were basically flat since our last Insight. U.S. equities have exhibited a sustained upward trend since the quarter began, having risen 10.2% over that timeframe. Outside the U.S., equities declined modestly by 0.2% over the week but this slight hiccup does not tarnish the 14.0% advance in foreign equities since the quarter began.

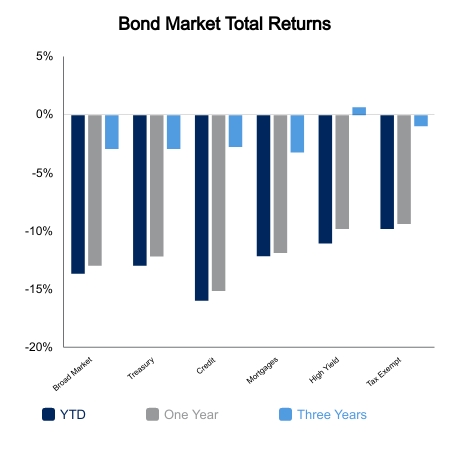

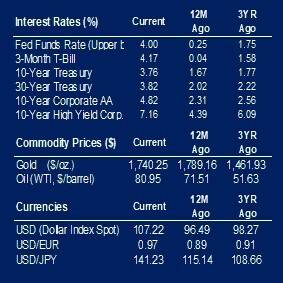

Yields on the short-end rose while yields on maturities longer than 5-years stayed flat. Bonds rose 0.4% week-to-date yet have declined 13.3% year-to-date.

All eyes continue to be on monetary authorities. Within the U.S., sentiment appears to be skewed toward a slower rise in rates. According to FactSet, the probability of a 50-basis point increase by the Fed appears to be in the offing. This has been one of the tailwinds behind the quarter‑to‑date rise in domestic equities. Inflation remains a critical focus by the Fed, even with recent economic reports exhibiting some moderation in inflation since the high observed in July. Outside the U.S., monetary authorities appear committed to raising interest rates in their ongoing efforts to battle inflation.

Housing starts for October declined 4.2% month-over-month, more than the estimated decline of 0.6% and September’s decline of 1.3%. Likewise, the final report on Building Permits for October of 1,512,000 was below the preliminary report of 1,526,000. Surprisingly, homebuilders have outperformed quarter-to-date rising 14.7%. Year‑to‑date homebuilders have declined 28.1%.

Recent surveys by regional Federal Reserve Banks exhibited weakness. The Philadelphia Fed Index, a measure of overall manufacturing conditions, reported its general activity index declined for November, as did its employment index, while new orders remained negative. Shipments remained positive but low. Overall respondents suggest that firms expect overall declines in activity and new orders six months from now. The Richmond Fed Index also contracted, albeit at a rate somewhat better than October’s print.

On a positive note, Durable Goods Orders for October surprised to the upside, rising 1.0% versus expectations of 0.4% and higher than September’s 0.3%. Similarly, Orders ex‑Transportation advanced 0.5% versus expectations of 0.1% while trending positive versus September’s negative print of 0.9%.

U.S. exchanges will reopen on Friday for an abbreviated session, closing at 1:00 p.m. EST. The bond market will follow a similar suit, closing at 2:00 p.m. EST.

On behalf of BTC Capital Management, we wish you safe travels and hope you have a great Thanksgiving.

|

|

Source: BTC Capital Management, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.