Strength in the housing industry continued this week as 999,000 new homes were built in October. This number is better than the expected 972,000.

Durable goods orders continued to be resilient in October. The growth of 1.3% was higher than the expected 0.95%. This is the sixth month in a row new orders are up. The growth is led again by transportation equipment. We also saw strong increases in orders of both nondefense aircraft parts and defense aircraft parts.

Personal consumption expenditure (PCE) for October was a little higher than expected at 0.5%. The anticipated number was 0.4%. Year-over-year, PCE is up 1.2%, which is right in line with expectations. The PCE is the preferred inflation measure of the Federal Reserve. Of the $159.2 billion increase seen in October, $109.9 billion came from spending on goods and $61 billion from spending on services.

Consumer sentiment, as measured by the University of Michigan, dipped slightly this month to 76.9 from last month’s 77. The dip may be attributed to consumers’ reactions to increasing COVID-19 cases.

While the airline industry had been seeing improvements in travel trends from May, forward booking trends are now worsening due to increasing COVID-19 cases. Several flights around Thanksgiving and Christmas have been cancelled due to the increasing numbers. Some states are increasing gathering restrictions to help limit the spread of the virus.

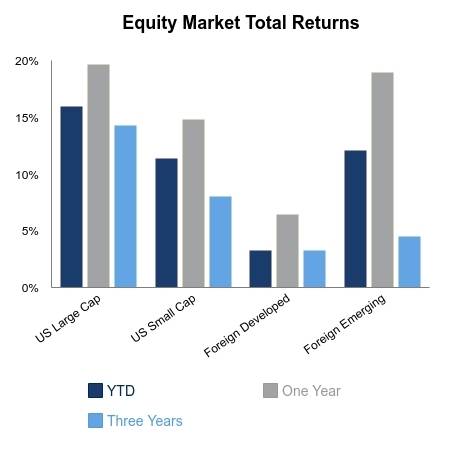

Positive vaccine news continued as more companies and institutions announced the efficacy of their COVID-19 vaccines. The announcements have contributed to a positive S&P 500 one-week performance of 0.76%. The performance is led by the Energy sector, up 10.48% this week and the Financials sector, up 3.93%. These sectors are the two worst performing sectors year-to-date with returns of -30.33% and -4.92% respectively. Demand for oil is expected to increase as people start to move around more after the roll out of the vaccine. Performance for the airline industry was up 9.13% this week in anticipation of increased travel next year.

The worst performing sectors for the week were the Real Estate and Health Care sectors, recording performances of -2.55% and -2.05% respectively.

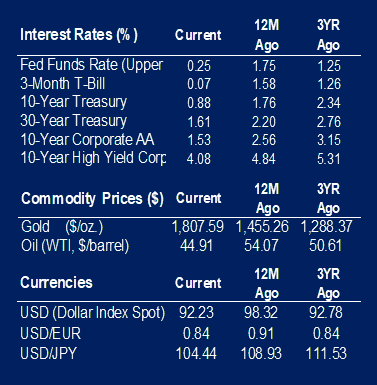

A major talking point in oil this week is on the relevance of the Organization of the Petroleum Exporting Countries (OPEC). The murmurings come as the organization meets on Thursday to discuss oil policy. The discussions are expected to focus on production cuts.

From all of us at BTC Capital Management, Happy Thanksgiving!

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.