The VIX Index hits its lowest level since 2020

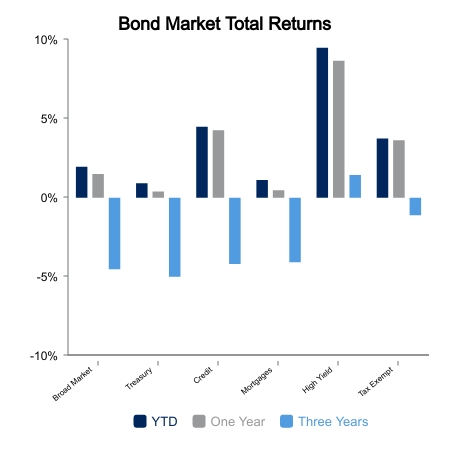

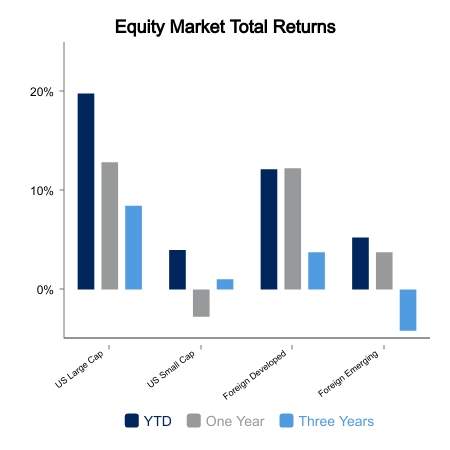

Equities were flat as volatility squeezed lower amid reduced holiday activity. The S&P 500 and NASDAQ Composite were close to unchanged on the week. Small caps fared better with gains of 0.5%. The VIX Index fell under 13 for the first time since the COVID outbreak. Core bonds gained 1.1% on the week as corporate bond spreads tightened alongside falling yields. The 10-year Treasury hit 4.25% this week, which is 75 basis points lower than its October high.

Can the consumer rise again?

Economic data was light on the week. The all-important jobless claims remained low at just above 200,000. Some attention is shifting to continuing claims, which have pushed to their highest level this cycle. New home sales came in lighter than expected, but the 50-basis point drop in mortgage rates would not have been reflected in the October number.

Real disposable personal income is up 3.9% versus the prior year. For context, this averaged a 2.5% annual gain in the decade prior to COVID. Several retailers have seen incredible stock performance in the second half of the year. Abercrombie & Fitch is up more than 260% from its 52-week low, which is better than NVIDIA. Gap jumped 30% on its earnings day to climb more than 175% off its 52-week low.

Several factors are now lining up as tailwinds for consumers and economic activity:

- Above average real disposable personal incomes

- Average retail gas prices have nosedived from $3.90 per gallon to $3.25

- Mortgage and auto rates are off their peak levels

- Financial conditions have eased considerably as the Fed signals no further rate hikes

- Stock and bond prices have improved which contribute to the wealth effect

- Interest on cash balances is well above post-Global Financial Crisis averages

Falling Treasury yields are a welcome relief to Japan. They want to back away from yield-curve-control without their bond market yields spiking. A drop in all global sovereign yields helped take their 10-year government bond yield from 95 basis points to 67 basis points. Their currency has pushed well under the critical 150 level as well. Conflict in the Middle East is also on the easing path. These were two of the larger global risks, but now have a trajectory change on both. Throw in the assumed end of the Fed rate hiking cycle and you can understand why the VIX Index is at a three-year-low.

|

|

Source: BTC Capital Management, The VIX Index

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.