Stocks Rally as Powell Guides to 50 in December

Fed Chair Jerome Powell signaled the pace of rate hikes would slow and could come as soon as the next meeting in December. The S&P 500 rallied more than 3% on the day. It was the fourth-consecutive time the market moved 3% on the day Powell spoke. The previous three times were declines, but those looking for a repeat were caught wrong-footed this time.

Not a Normal Cycle

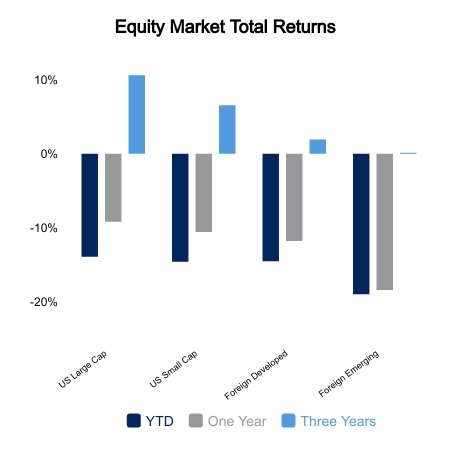

The S&P 500 ended the month of November up 5.6% for its second-consecutive monthly gain of at least 5%. The Dow Jones Industrial Average has now rallied 20% from its low and is only down 2.9% on the year. There is an increasing view that a new bull market has begun given that inflation is clearly rolling over. A few interesting data points will be put to the test:

- The S&P 500 recorded its 12th occurrence of at least a 10% two-month gain while also having a negative six-month return. It posted positive returns six months and 12 months forward in all previous cases.

- When a recession occurred, the market has never bottomed until after the Fed began cutting interest rates.

- The U.S. Leading Economic Index has fallen for eight-consecutive months. Each of the seven times it has fallen seven straight months, a recession occurred.

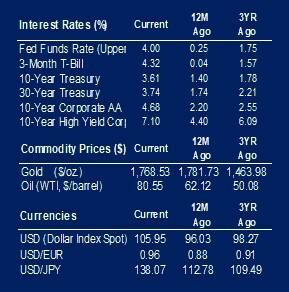

- The 2-year and 10-year Treasury yields are now inverted by 73 basis points, which is more than the level prior to the last four recessions.

Making things more difficult this time around are the continued rate hikes in the face of weak economic growth. In March, Jerome Powell said the yield curve with 100% explanatory power was the yield on the 3-month Treasury Bill in 18 months minus the current 3-month yield. He said, “If it is inverted, it means the Fed is going to cut, which means the economy is weak.” At the time, the curve was above 2%. Now it is inverted by 40 basis points, a level associated with recession. When asked about it recently, he blamed other factors and maintained that further interest rate increases are necessary.

Will Payrolls Continue to Hold Up?

Jobless claims remain low with a weekly reading of 240,000. However, job cuts had a big jump to 76,000 versus readings around 20,000 during economic growth phases. Manufacturing survey data continues to be very weak, and ADP confirmed this by reporting a loss of 100,000 manufacturing jobs this week. The consensus is looking for +200,000 job gains in the monthly payrolls report tomorrow.

|

|

Source: BTC Capital Management, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.