Equities Continue to Slide

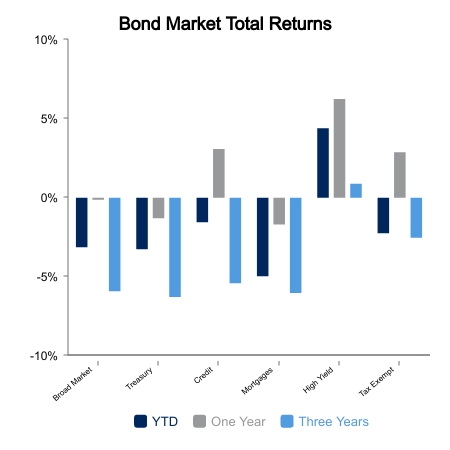

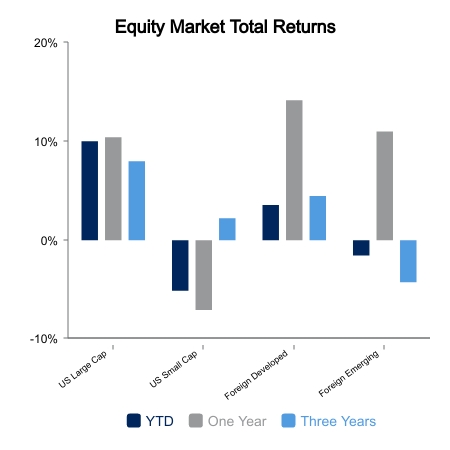

Equity markets declined this past week, given the sustained rise in yields. U.S. equities declined 3.2% with U.S. small caps falling 4.5%, the worst performer for the week. Foreign equities declined 2.1%. Bonds also declined over the week.

Higher‑for‑Longer

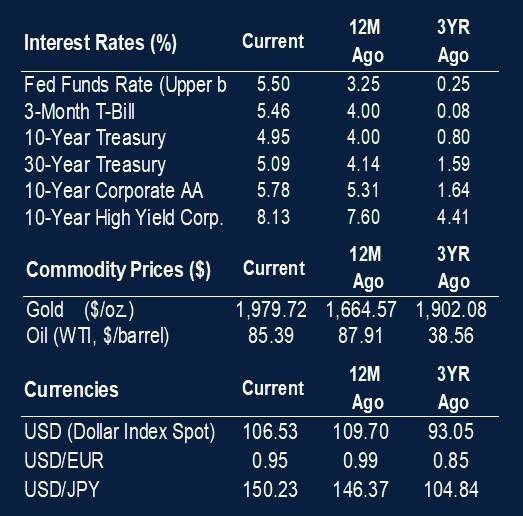

The yield on the U.S. 10-year Treasury rose above 5.00% for first time since 2007, this rise having accelerated since July. As of yesterday’s close, the yield on the 10‑year stood at 4.96%.

The mantra “higher-for-longer” has been ubiquitous since mid‑August, reflective of a fluid macro environment. This morning the European Central Bank determined to keep its three key interest rates unchanged, given its “assessment of the medium‑term inflation outlook,” which is expected to stay high for too long in the face of what it described as “strong domestic price pressures.”

Today the Bureau of Economic Analysis released its first preliminary report for U.S. Gross Domestic Product (GDP) for the third‑quarter. Real GDP increased at an annual rate of 4.9%, which compares to 2.1% for the second quarter. This increase, the fastest rate of growth in GDP over the last two years, was attributed to increases in consumer spending and inventory investment.

Over this past week Markit, a division of S&P Global, released its regional Flash (preliminary) Purchasing Managers’ Index (PMI) series for October. The PMI series is a diffusion index indicating whether market conditions, represented by the service and manufacturing sectors, are expanding or contracting as assessed by purchasing managers. A reading less than 50 implies contraction, while a reading greater than 50 implies expansion.

Across the globe, the manufacturing series for regions outside the U.S. continued to exhibit contraction, with the Eurozone at 43.0. Japan held steady at 48.5. The surprise was within the U.S., which improved to 50.0 from September’s 49.8.

The services sector, the larger of the two sectors measured, also reflected contraction outside the U.S. The Eurozone declined month‑over‑month to 47.8 from September’s 48.7. Within the U.S., the service sector improved to 50.9 from 50.1 for September.

Third Quarter Earnings

According to LSEG, 77.9% of companies comprising the S&P 500 Index that have reported third quarter earnings have beat analyst estimates, exhibiting an average beat rate of 6.9%. Note the beat rate has declined from earlier in this reporting season. Any response to this positive aspect has been muted by the higher‑for‑longer mantra. Forward guidance by corporations has been muddled. Lastly, negative revisions by analysts to forward earnings estimates currently outpace positive revisions. Stay tuned.

|

|

Source: BTC Capital Management, Bureau of Economic Analysis, Markit, LSEG

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.