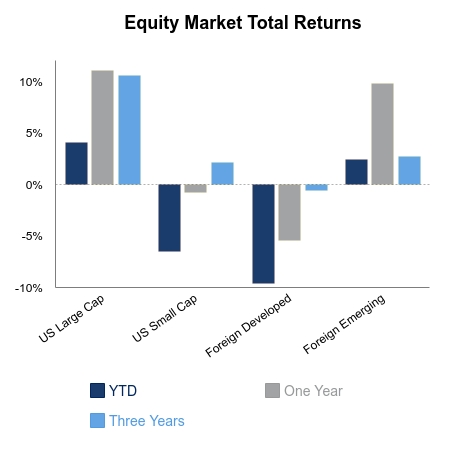

We continue to navigate our way through earnings season this week. With a little over 50% of S&P 500 companies reporting, it looks like things were not as bad as we thought they would be. Not great, just not as bad as expected. Of the companies that have reported so far, the average reported decline in earnings was 9.10%. This is close to 25% better than expected. Sales declined by an average of 3.34%, which was 3% better than expected. The Health Care, Utilities and Consumer Staples sectors are leading in growth for the quarter. Equity markets are down this week despite the better than expected earnings results due to an uptick in COVID-19 cases and the delay in fiscal stimulus. Volatility in the markets is expected to continue through the election cycle.

Strength in housing continued this week. In September, 6.54 million existing homes were sold. This number is better than the expected 6.25 million and the previous month’s 5.98 million. The number of building permits issued was inline with expectations at 1.545 million. New home sales were a little lighter than expected at 959,000 versus 1 million.

Orders for durable goods increased by 1.9%. This preliminary number is significantly higher than the expected growth of 0.60% and last month’s 0.36%. This is the fifth straight month of increases in orders. The increase was led by transportation equipment orders, which were up 4.1%. Orders for defense goods were a drag on the headline number.

Consumer confidence for October is at 100.9. This confidence could lead to increased spending by the consumer. The number is slightly lower than the expected 101.8 and last month’s 101.3.

Manufacturing continues to be a positive contributor to economic growth. The Kansas City Fed Manufacturing Index number for October was 13. Higher than the previous month’s and the expected 11. The Dallas Fed number was also strong at 19.8. The expectation was for a reading of 14.3. The Richmond Fed number came in at 29. Economists expected a reading of 18. The strong manufacturing numbers indicated economic strength.

Markit PMI Manufacturing was at 53.3. This number indicates positive economic momentum. The service PMI number was also strong at 56.

The leading indicators number for September was 0.70. This index is a composite of 10 leading indicators. The better than expected number adds to the story of upcoming economic growth.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.