To Our Readers,

Today’s edition of the Weekly Insight is a special one for BTC Capital Management. It represents the completion of 10 consecutive years of producing this publication as our first issue was produced on August 31, 2011.

We hope you continue to find the content of Weekly Insight informative and relevant as we embark on the next 10 years of preparing and distributing it to you.

Thank you again for your continued readership.

Sincerely,

Jon K. Augustine, CFA

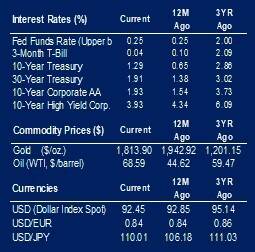

Inflation was up 4.2% year-over-year as measured by the Personal Consumption Expenditure (PCE) Index. Month-over-month, the index was up 0.40%. The increase reflects rises in both goods and services. There was a large increase in energy for the month; the industry was up 23.6%. Excluding energy and food, PCE was up 3.6% over the year and 0.3% over the month. Inflation has been a major talking point this year. Federal Reserve Chair, Jerome Powell, reaffirmed the Federal Reserve’s (Fed) stance of the expectation of transitory inflation. At this time, there is no indication the Fed will be making policy decisions based on tackling inflation.

Personal income grew by 1.1% in July. The increase was led by Child Tax Credit payments going out and an increase in employee compensation. The rise is meaningfully higher than last month’s increase of 0.2% and the expected 0.3%.

Consumer confidence, as measured by the Michigan Sentiment Indicator, was a little weaker than expected. August’s 70.3 reading was lower than the expected 71.2. The Conference Board’s Consumer Sentiment Indicator was also lower at 113.8 versus 124. The lower numbers have been attributed to consumer reactions regarding the surging Delta variant, higher inflation, slower wage growth, and smaller declines in unemployment according to the Conference Board.

The pending home sales number for July was down 1.8%. Supply not meeting demand has contributed to the dip. The only region that recorded an increase was the West region. The Northeast region fell 6.6% and the Midwest region was down 3.3%. We are seeing a slow increase in housing inventory.

Home prices increased by 1.8% in June according to the S&P/Case-Shiller 20 City Home Price Index. June’s increase contributes to annual price growth of 19.1%. The persistent increase in home prices has contributed to middle- and lower-income families being priced out of home sales.

Non-farm private employment was weaker than expected. The increase of 374,000 jobs compares unfavorably with the expectation of 625,000. Despite the lackluster number, we saw growth across all sizes of businesses. Small businesses added 86,000 jobs, midsized businesses added 149,000 jobs and large businesses added 138,000 jobs. Most of these roles were service jobs, up 329,000. The lower-than-expected number was attributed to the Delta variant.

We continue to see strength in manufacturing. The Markit PMI Manufacturing number in August was a strong 61.1. This number was right in-line with expectations.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.