Summer Doldrums

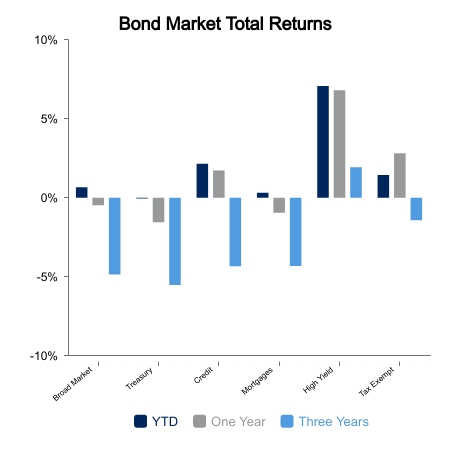

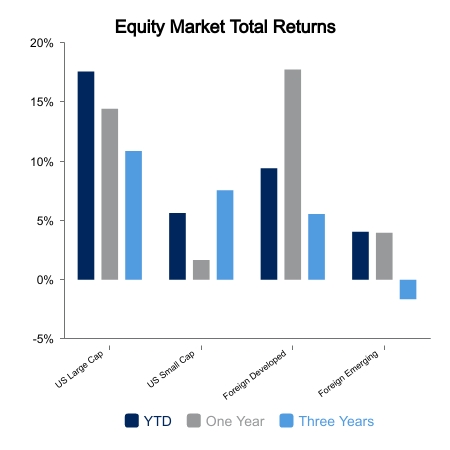

Over the last week, fixed income rose to the top regarding cross-asset performance, rising 0.3%. U.S. equities declined 0.1%, as U.S. small caps fell 1.0% while large caps were flat. Outside the U.S., emerging markets declined 0.6% while foreign developed eked out a modest 0.1% increase.

Economic Tea Leaves

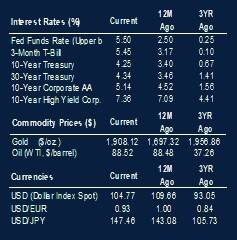

Inflation has been front‑of‑mind with the Fed. The U.S. Bureau of Labor Statistics (BLS) released its Consumer Price Index (CPI) for August. CPI rose 0.6%, matching consensus expectations. Over the last 12 months, CPI has risen 3.7%, modestly above expectations and ahead of July’s 3.2%. Gasoline was the largest contributor, accounting for over half of the increase while the Energy component rose 5.6% in August. Note oil prices now hover around $90 for West Texas Crude having increased from approximately $79 in mid-August. CPI ex-Food & Energy rose 0.3% during August, following July’s 0.2% increase, driven by increases in rent, owners’ equivalent rent, motor vehicle insurance, medical care, and personal care. BLS also released its Producer Price Index for August, which rose 0.7% exceeding expectations. Like CPI, the main culprit was the energy component.

BLS reported hourly earnings for August increased 0.2% versus consensus expectations for a contraction of 0.4%. Year‑over‑year hourly earnings increased 4.3%, in line with July’s increase and modestly ahead of headline CPI.

Concerns about consumer spending are ever-present. It is believed any savings accumulated during the pandemic are nearing exhaustion. Coupled with the end of the student loan moratorium and other deferral programs initiated during the pandemic call into question the sustainability of consumer spending. The Federal Reserve released its report on consumer credit for July, which increased $10.4 billion. This was below consensus expectations of $16.0 billion and below June’s $14.0 billion. Revolving credit increased at an annual rate of 9.2%, while nonrevolving credit increased at an annual rate of 0.2%. That said, retail sales for August surged by 0.6%, handily exceeding expectations and July’s increase of 0.5%

The National Federation of Independent Business (NFIB) released its Small Business Index for August. The Index decreased 0.6% in August to 91.3, which was the 20th consecutive month below its 49‑year average of 98. Expectations for better business conditions decreased to a net negative 37%, although that was 24 percentage points better than June’s reading of negative 61%. Small business owners indicated job openings were hard to fill, a situation that remains at historical highs.

Inflation appears to be sticky, which continues to be critical to the Fed. Coupled with with a backdrop of a weaker economic environment, it appears to be a muddled path going forward for now.

|

|

Source: BTC Capital Management, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.