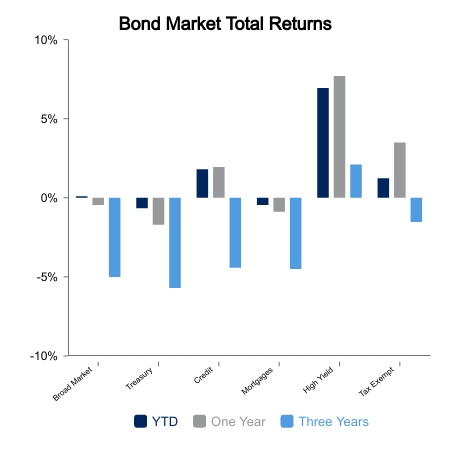

Bond Yields Break to New Highs

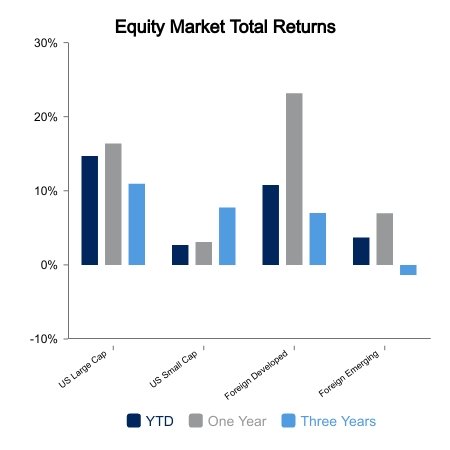

Equities were down on the week as bond yields finally broke out to cycle highs. The S&P 500 was down 1.4% on the week. The NASDAQ was weaker with a drop of 2.5% as higher beta names underperformed. Core bonds were down 0.6%. Core bonds have fallen more than 4% from their year-to-date high and are now underwater on the year. The S&P 500 currently sits about 5% below its year-to-date high, while the NASDAQ is about 7.5% lower. Small caps are more than 10% lower.

Economic Data Remains Resilient

Economic data came in better than expected this week. Retail sales and building permits exceeded expectations. Jobless claims remained low last week and then dropped to 201,000 this week. Recession risks continue to be faded until there is a material weakening in the labor market, which likely only materializes when jobless claims push toward 300,000.

The Fed Pauses

The Federal Reserve at its September meeting paused and left the Federal Funds Rate at 5.5%. They moved up their expectations for the median rate in 2024 by 50 basis points to support their higher for longer stance. Bond yields initially flattened after the press conference with 30-year Treasuries a little lower in yield. However, today 30-year yields are much higher after jobless claims came in better than expected. If the Fed overtightens, then long-end yields come down. This has generally been the expectation among market participants. This is why some yield curve inversions have set record consecutive weeks of inversion.

With the Fed on pause, good economic data or higher inflation outlooks are likely to steepen the yield curve and send long-end rates higher. This is due to the perception that the Fed will let inflation re-accelerate and again be behind the curve. A lot of attention is on oil, where prices have hit $90 per barrel. This is more than 30% above the summer low. The average gas price nationwide has moved up 25% to $3.87 per gallon. Fed Chair Jerome Powell seemed to downplay oil price gains in their inflation outlook as a non-factor until they become persistent. He noted instead their growth inhibiting impacts.

With the move higher in interest rates today, 30-year mortgages now average 7.59%, the highest since 2000. With homeowners not wanting to part with locked in low rates, existing home sales are down 38% from their 2020 peak. In 2008, the trough was 48% below the peak.

|

|

Source: BTC Capital Management, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.