The past week was relatively light in terms of data releases but some of the updates were meaningful in helping to assess the current economic environment. On the labor front both initial and continuing jobless claims were below consensus estimates and the prior week’s report. Ongoing strength on the jobs front has been a key component of economic growth this year as citizens with jobs have the capacity to spend and consumption accounts for approximately two thirds of U.S. GDP.

Housing affordability continues to deteriorate as the 30-year fixed rate mortgage crept back up to 7.19% this week as reported by the Federal Reserve Bank of St. Louis. In addition, the most recent data for the Case-Shiller 20-city Home Price Index registered a month-over-month increase of 0.90% in July. This followed an increase of 0.91% in June. On a year-over-year basis the index rose less than expected but did register a positive result at 0.13%. This compares to the -1.2% the prior month and represents the first positive reading since February.

Consumer confidence also showed erosion as the Consumer Confidence Index registered a lower-than-expected reading that also trailed the prior month’s result. This was the second consecutive month of declining confidence. A component of the overall confidence reading is the Expectations Index which declined to 73.7 from a prior reading of 83.3. Driving this decline was consumer’s deteriorating short-term outlook for income, business, and labor market conditions.

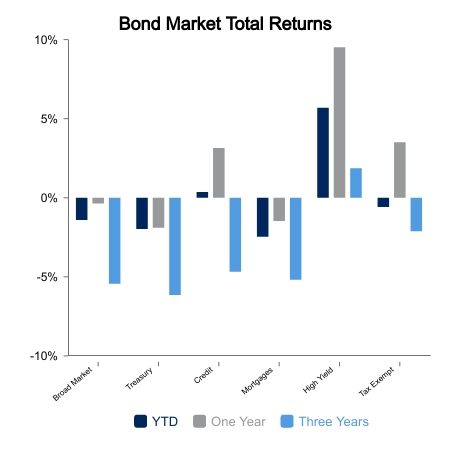

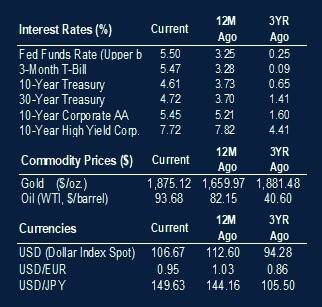

Financial markets struggled last week as investors continued to digest the messaging from last week’s meeting of the Federal Reserve’s Open Market Committee. Rising yields pushed aggregate bond index returns into negative territory on a year-to-date basis as the yield on the 10-year U.S. Treasury issue rose to 4.61%. This is the highest level for the 10-year in 15 years. In terms of shorter maturities, the 2-year Treasury issue was relatively flat for the week.

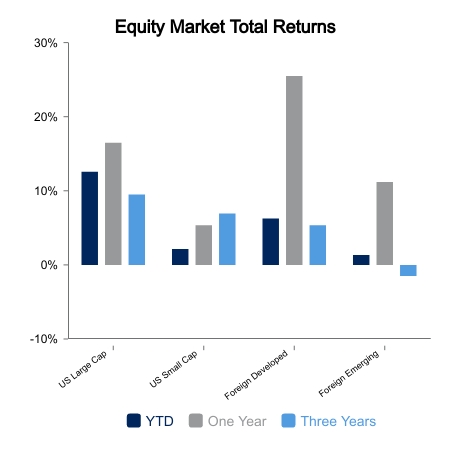

Equities joined the fixed income markets in posting negative returns for the week. U.S. equity markets, as measured by the Russell 3000 Index, posted a weekly return of -3.7%. The Russell 2000 Index of small company stocks fared slightly better with a return of -2.6%. While small caps fared better over the past week they have lagged large caps on a quarter-to-date basis with a return of -5.5% while large caps have returned -3.6%. International equities also declined last week with the MSCI EAFE Index of developed markets returning -2.3%.

Key economic data releases over the next week include the final estimate of second quarter GDP and additional readings on consumer sentiment.

|

|

Source: BTC Capital Management, FactSet, Federal Reserve Bank of St. Louis.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.