Equities Retreat as Bond Yields Approach Their Highs

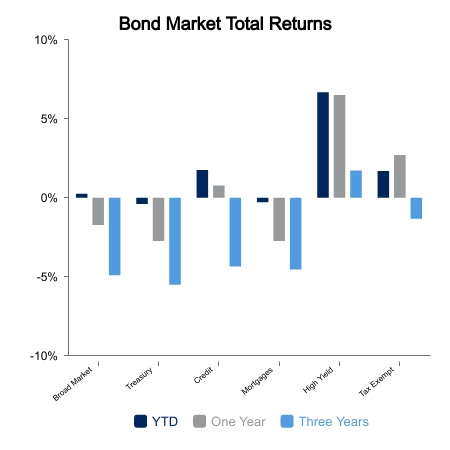

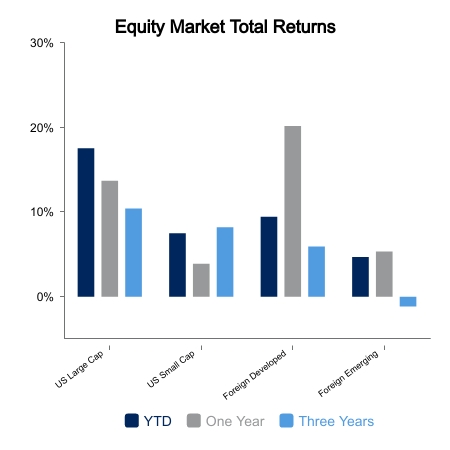

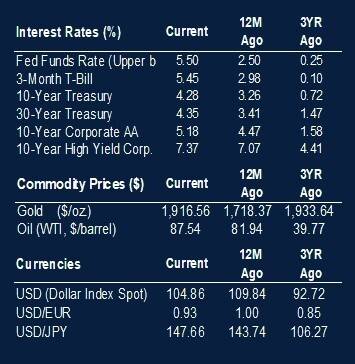

Equities where down on the week amid mixed economic data and rising bond yields. The S&P 500 was down 1.1% while foreign equities dropped 1.5%. Core bonds declined 1% as the 2-year Treasury revisited 5% and 10-year Treasury yields approached their highs. The 10-year Treasury finished the week at 4.28%, its third highest daily closing level this year.

Data Dependent Whipsaw

Economic data continues to send a mixed picture although more red flags are appearing. Nonfarm payrolls were up 187,000 in August, which was close to expectations. The red flag is the seven consecutive months of downward revisions versus the initial release. The cumulative downward revision is over 300,000 and something normally associated with recession. The unemployment rate jumped from 3.5% to 3.8%. The unemployment rate has now risen 0.4% off the lows and this is rare outside of recession. The optimistic take is that 211,000 people were added to payrolls using the household survey, which is a different survey than the 187,000 reported above. The red flag is that 736,000 individuals entered the labor force, potentially due to tighter financial conditions at home.

ISM manufacturing data came in at 47.6 which is weak, but slightly better than expected. New orders remain weak with a reading of 46.8, but inventories had an even lower reading. Often when new orders exceed inventory readings there is at least modest growth in the following months. Despite weak numbers, the Purchasing Managers’ Indexes have stabilized, and some suggest this is a sign of economic strength. Others suggest that given the highly visible labor strikes, including the potential for a United Auto Workers strike this month, businesses are front-running activity.

Bank credit and commercial loans have gone negative versus the prior year. Auto delinquencies and credit card charge offs are also moving up. However, jobless claims have dropped back down, and ISM services exceeded expectations with a reading of 54.5. Oil moving up toward $90 per barrel has also gotten some attention as Saudi Arabia extended supply cuts this week. However, raw industrial prices are not moving higher. This is something that has been in place all year and has resulted in oil prices staying range bound each time they looked ready to begin a sustained uptrend.

The Fed has emphasized their data dependency regarding future rate hikes, thereby removing any pre-emptive cut. It is likely we would need to see clear weakening in nearly all economic data series to induce a cut. The market has repriced the expected Federal Funds rate in December 2023 from 4.5% in January up to its current reading of 5.5%.

|

|

Source: BTC Capital Management, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.